FY2021 Social Impact Assessment Report

In FY2021, we conducted a social impact assessment to visualize the social impact of the Promise Financial and Economic Education Seminar as last year. The Seminar is at the core of SMBC Group's social contribution activities. This assessment was conducted based on an awareness that corporations have become required to bring about social impact through their business activities.

Through this assessment, we will fulfill our duty for stakeholder accountability about the project outcomes while also working to make a more effective program structure and improvements to the program based on the proposals and insights gained.

- FY2021 Social Impact Assessment Report of Promise Financial and Economic Education Seminar (906KB)

- FY2021 Social Impact Assessment Report of Promise Financial and Economic Education Seminar(Appendix) (1,356KB)

1. Assessment summary

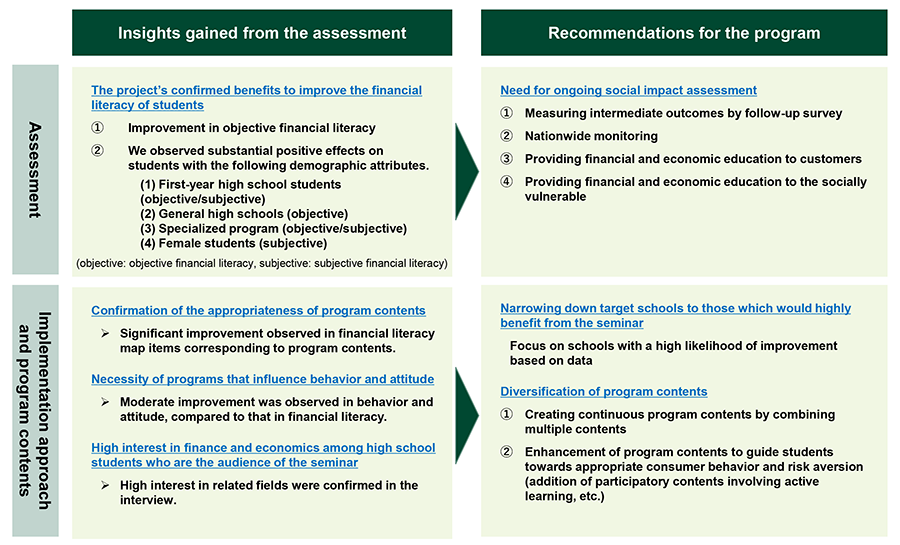

In FY2021, our social impact assessment on the effectiveness of the “Promise Financial and Economic Education Seminar” project is based on the logic model proven to be effective in the FY2020 assessment. To estimate the social impact brought about by the project as a whole (cumulative total participants of 1,200,000 to date), we compared the results of a questionnaire survey of more than 1,500 students from 11 high schools and interviews of selected students who participated in the seminar against responses from the control group consisting of students who did not participate in the program. The following are insights gained from this assessment and our recommendations for the program.

- ●Insights gained from the social impact assessment

- 1.Improved financial literacy through the project

- ・We believe the project was effective in improving financial literacy, given a significant improvement in scores on objective financial literacy (categories in the financial literacy map) after taking the seminar. The project will highly likely improve the objective financial literacy of first-year students in high schools,students in ordinary schools and those in specialized programs.

- ・Compared to nonparticipating students, students who attended the seminar showed an improvement in scores on subjective financial literacy. The project is considered highly effective in improving the subjective financial literacy of specific demographics, such as first-year students in high school, students in specialized programs and female students.

- 2.Appropriateness of program contents

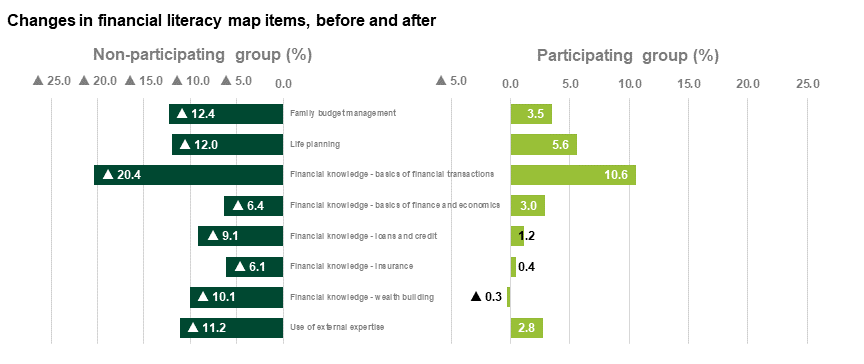

- ・The project provides programs specifically targeted to high school students including: life planning & family budget management program, loan & credit program, and financial problem program. After taking these programs, students scored better in many categories in the financial literacy map and items in the behavior and attitude segment. Thus, we believe the program contents were adequately effective.

- 3.High interest in finance and economics among high school students who participated in the seminar

- ・The results of our qualitative survey showed that there was an increase in the number of students who recognize the importance of learning finance and economics at school or who are interested in various financial and economic fields. The project was considered effective in raising the interest of students.

- 1.Improved financial literacy through the project

2. Overview of the subject project

- Project name

- Promise Financial and Economic Education Seminar

- Project developer

- SMBC CONSUMER FINANCE CO., LTD.

- Project contents

- Supporting students and local people responsible for the future to acquire accurate knowledge concerning money so that they can make appropriate decisions by holding free financial and economic education seminars at the customer service plazas or local schools.

- Achievements

- Cumulative total participants Approx. 1,010,000 people(FY2011 to FY2020)

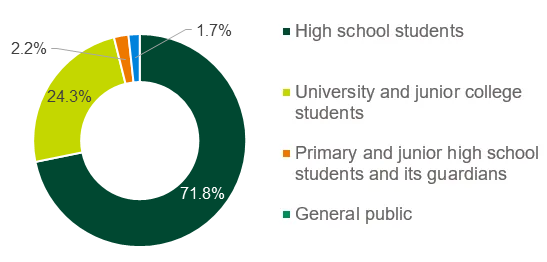

[Demographics of participants]

SMBCCF : Initiatives for Financial and Economic Education (Japanese only)

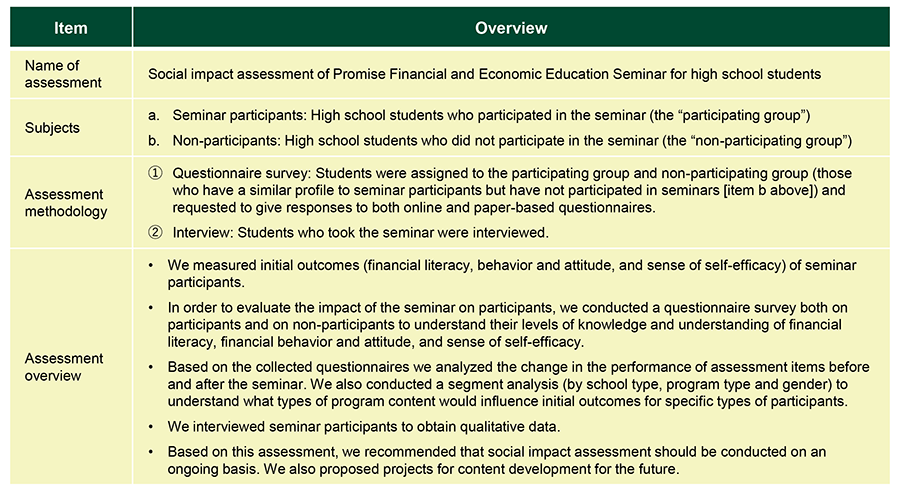

3.Overview of the Social Impact Assessment

- ●The social impact brought about by financial and economic education

- ・The expected social impact is as listed below (1. to 3. are from the report of the Study Group on Financial Education)

- 1.Improvement in life skills and realization of prudent household finances

- 2.Improvement in the quality of financial services

- 3.Supply risk money necessary for economic growth by changing the structure of Japan's wealth building

- 4.Improvement in response to and prevention of financial trouble

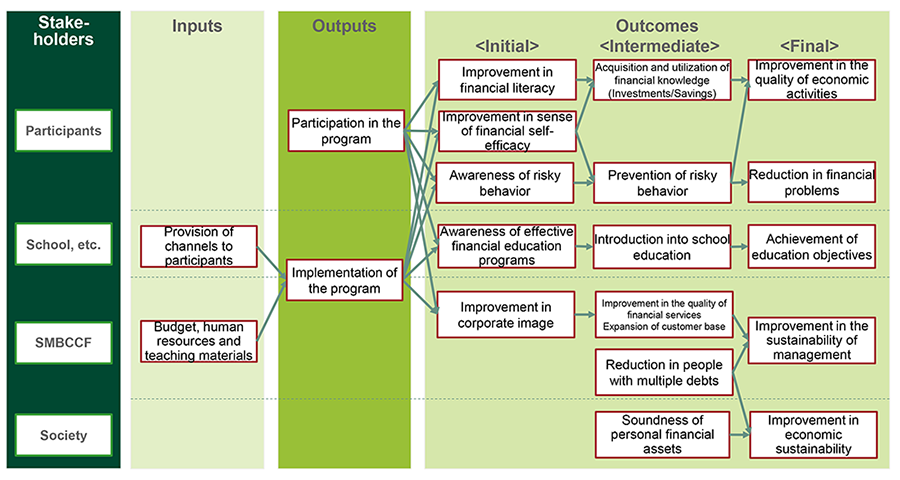

- ●Anticipated logic models

- ・From previous studies and the program's materials, logic models that show the expected social impact of financial and economic education anticipate the below.

- ●Overview of implementation

- ・Our FY2021 assessment was targeted at high school students. They account for a substantial part of the project’s target audience. We estimated the social impact of the program on this segment through the enhanced methodology with improved accuracy.

4.Main results of the analysis of the Social Impact Assessment

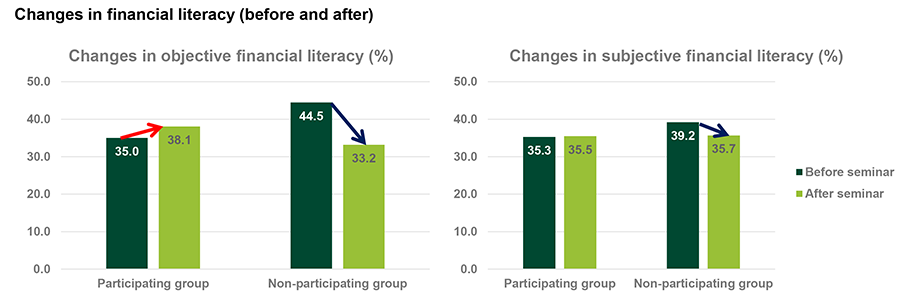

- ●Changes in financial literacy that occur as a result of take the seminar

- ・We compared changes in scores in objective and subjective financial literacy before and after the seminar both for the participating and non-participating groups. After the seminar, scores improved for the participating group while dropping for the non-participating group.

- ●Changes in financial literacy map items after the seminar