FY2022 Social Impact Assessment Report

Financial education is increasingly attracting attention in FY2022, as it was introduced in earnest in school education after the age of majority was lowered and the curriculum guidelines were revised, and promotion of enhancements to financial and economic education aimed at raising awareness about the importance of stable asset formation was stated in the Doubling of Asset-based Incomes Plan. The SMBC Group assessed the social impact of financial and economic education in FY2020 and FY2021, and again conducted the assessment in FY2022.

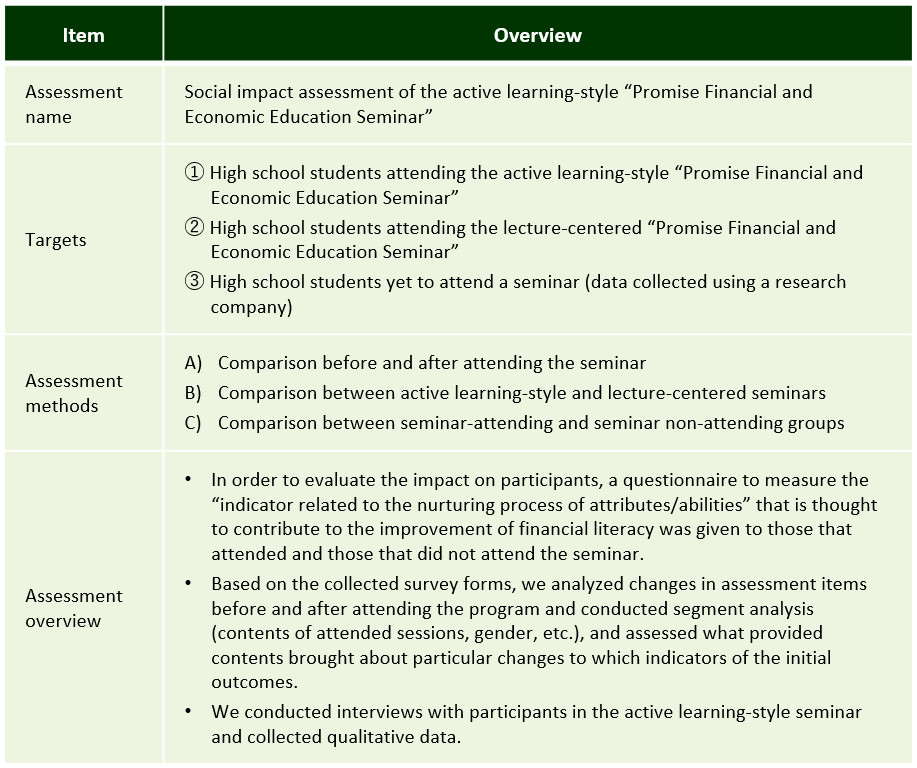

We have conducted an assessment on the difference in the impact created between conventional “lecture-centered seminars” and ”active learning-style seminars,” which are group work-style programs on questions without answers with “money” as the theme, using questionnaire surveys on over 1,600 individuals from 13 schools nationwide and interviews with selected participants, comparing them with a target group who have not attended the programs.

This assessment was conducted by Social Value Japan.

1. Assessment summary

Knowledge gained from the social impact assessment

1. Program confirmed to have improved financial literacy

- ●Attendance in the seminars (both the active learning-style and lecture-centered seminars) was confirmed to result in a mild improvement in objective financial literacy (financial literacy map area), with an especially strong impact observed on female students.

- ●In terms of subjective financial literacy, scores improved in all attributes after attendance in the active learning-style seminar, leading us to believe that the courses can have a strong impact. No impact was observed on female students attending lecture-centered seminars, but male students attending lecture-centered seminars saw improvement in their subjective financial literacy.

2. Confirmation of impact through execution of an active learning style

- ●While scores for the development process of attributes/abilities were found to have mildly improved after attending lecture-centered seminars, they increased significantly mainly in ”interest/curiosity,” ”critical thinking,” and ”use of external knowledge” after attending active learning-style seminars, leading us to believe that attendance in active learning-style seminars will have a strong impact. We believe that this reflects the fact that attendance in active learning-style seminars, where students actively participate in the learning process, creates an opportunity to stimulate their interest in the financial/economic field and for them to recognize the importance of using external knowledge. We believe that there is compatibility between the purpose/method of the active learning-style “Promise Financial and Economic Education Seminar” and its impact.

3. Key Analysis Results of This Assessment

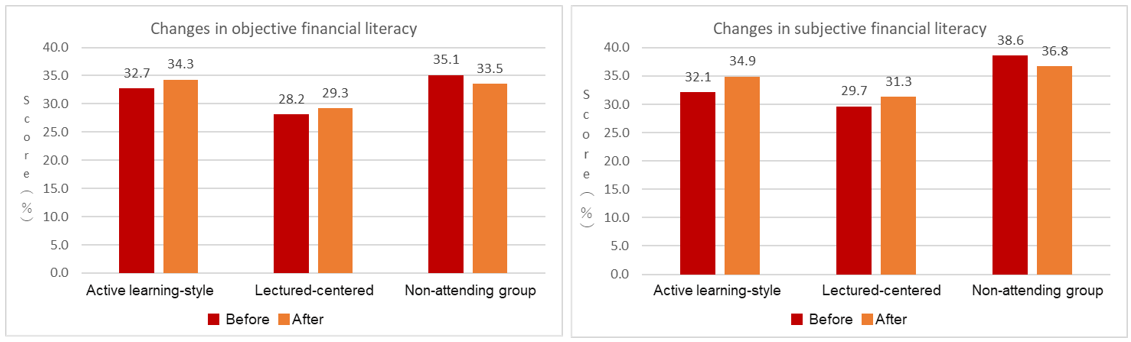

- 1.We compared changes observed after attending the objective and subjective financial literacy seminars for two courses of the attending group and the non-attending group as a whole.

- ●Objective financial literacy scores saw a mild uptrend for both active learning-style and lecture-centered seminar attendees.

- ●Subjective financial literacy scores of the attending group saw an uptrend. In particular, active learning-style scores increased significantly. This led us to surmise that attendance in active learning-style seminars can have a positive impact on subjective financial literacy.

- 2.Objective Financial Literacy: Comparison by Gender

- ●Objective financial literacy scores did not change significantly across all courses of the attending group, but when compared between genders, they improved from 34.0% to 36.9% for female students attending active learning-style seminars and from 28.6% to 30.6% for those attending lecture-centered seminars. Thus, both courses showed positive changes due to attending the seminar.

- ●No change was observed for male students, and a downtrend was observed for female students in the non-attending group.

- ●The results indicate that seminar attendance can have a positive impact on female students’ objective financial literacy.

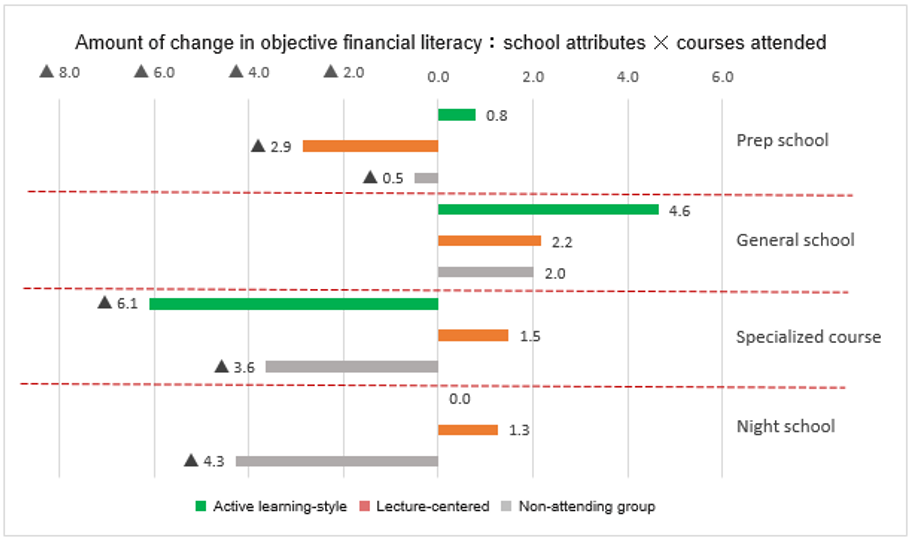

- 3.Objective Financial Literacy: Comparison by School Attributes

- ●A positive change was observed in subjective financial literacy for all school attributes that took the active learning-style seminars. In lecture-centered seminars, positive changes were observed in general schools and specialized courses.

- ●In specialized courses, positive changes were observed for both active learning-style and lecture-centered seminars. However, as scores improved in specialized courses even in the non-attending group, positive impacts of seminar attendance on objective financial literacy in specialized courses cannot be confirmed based solely on the results of this survey.

- ●In prep schools, a positive impact from active learning-style seminar attendance on subjective financial literacy can be expected.

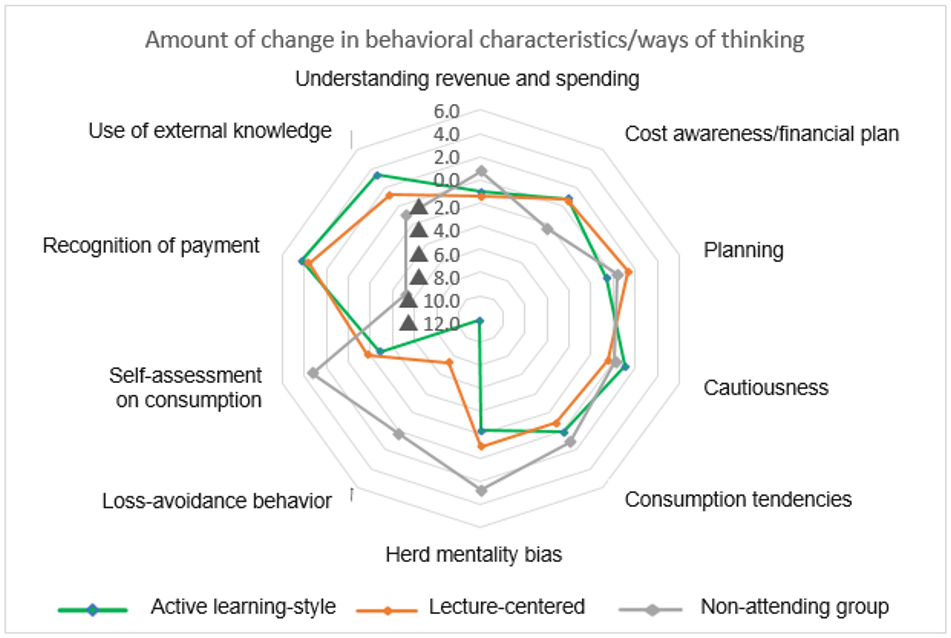

- 4.Changes in Behavioral Characteristics/Ways of Thinking After Attending Seminars

- ●In terms of behavioral characteristics/ways of thinking, positive changes were observed in ”Loss-avoidance behavior” and “Use of external knowledge” in active learning-style seminars, in which students actively participate in learning. We believe that the purposes and methods of this course, which aims to reinforce desirable behavioral characteristics/ways of thinking through topics such as investment, and their impact are aligned with each other.

* Herd mentality bias: Inverted item (an item that tends to get better as its value decreases)

4. Knowledge Gained From Analysis

- 1.Impact on objective financial literacy

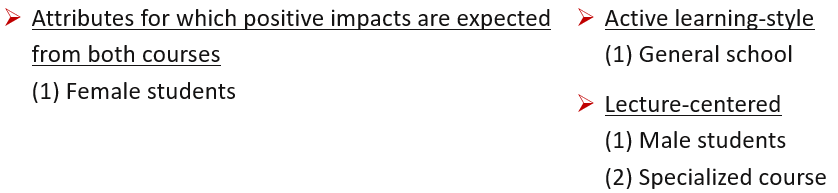

Objective financial literacy (financial literacy map area) scores improved mildly through attendance in the seminars. Scores for the non-attending group saw a downtrend. The Promise Financial and Economic Education Seminar can be expected to improve objective financial literacy in the following attributes.

- 2.Impact on subjective financial literacy

Subjective financial literacy scores improved in many items through attendance in the seminars. In particular, the improvement of subjective financial literacy through active learning seminars can be expected to have an effect on all attributes. The Promise Financial and Economic Education Seminar can be expected to improve objective financial literacy in the following attributes.

- 3.Confirmation of impact through execution of the active learning style

- (1)Behavioral characteristics/ways of thinking

- ●Positive changes were observed in ”Loss-avoidance behavior” and “Use of external knowledge” in active learning-style seminars, in which students actively participate in learning. We believe that the purposes and methods of this course, which aims to reinforce desirable behavioral characteristics/ways of thinking through topics such as investment, and their impact are aligned with each other.

- (2)Development process of attributes/abilities

- ●While scores for the development process of attributes/abilities were found to have mildly improved in a balanced manner after attending lecture-centered seminars, strong impact was confirmed mainly in ”interest/curiosity,” ”critical thinking,” and ”use of external knowledge” after attending active learning-style seminars. We believe that this reflects the fact that attendance in active learning-style seminars, where students actively participate in the learning process, created an opportunity to stimulate their interest in the financial/economic field and for them to recognize the importance of using external knowledge. We believe that the objectives and method of this course are aligned with their impact.

- ●In terms of the development process of attributes/abilities, rates of score improvement were higher for male students in many items of the lecture-centered seminars. In contrast, in active learning-style seminars, score improvement rates were higher for female students in ”Knowledge/understanding,” ”Interest/curiosity,” and “Self-efficacy.”

- ●We can infer that the active learning style is more effective for stimulating female students’ interest in finance and the economy and improving their sense of ownership and self-efficacy.

- (1)Behavioral characteristics/ways of thinking

- 4. Interest stimulation in investment activity (impact on “loss-avoidance behavior”)

For both active learning-style and lecture-centered seminars, scores decreased significantly only for “loss-avoidance behavior,” which asked about investment actions that involved risk, just as seen in the FY2021 assessment. Many high school students take it for granted that "investment involves risk," and we believe that attending the seminar increased their interest in investment, especially in finance and the economy. In particular, as this score changed significantly after attending an active learning-style seminar on the theme of investment, we believe attendance in the seminars has a significant impact on interest stimulation in investment activity indicated by “loss-avoidance behavior.”

- 5. Awareness improvement regarding the importance of financial and economic education

As the qualitative survey results indicated that the number of high school students who thought about the importance of finance and economy at school increased after attending the seminar, we believe that the Promise Financial and Economic Education Seminar improved high school students’ awareness about introducing financial and economic education. Qualitative analysis confirmed the following positive changes.- ●Change in risk behavior awareness and prevention awareness

- ●Improvement in awareness about information collection

- ●Stimulation of interest in various financial and economic information

- ⇒Positive and negative aspects of investment

- ⇒Ways and methods to pay taxes

- ⇒Pensions

- ⇒Workings of deposits and interest