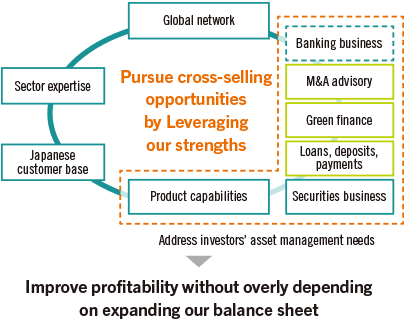

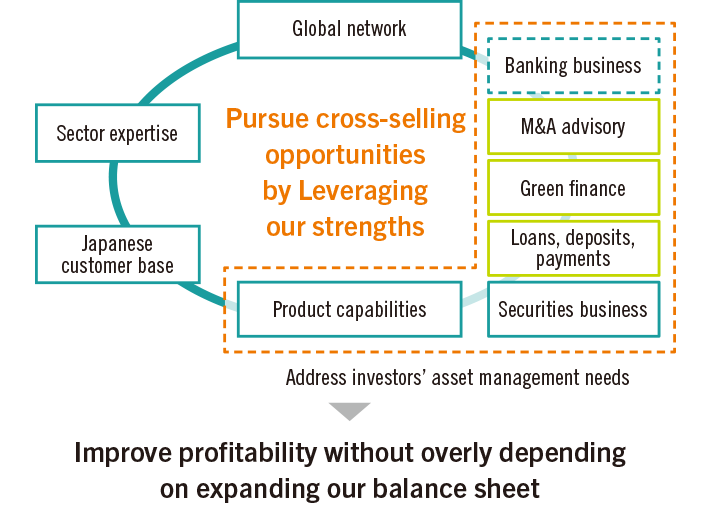

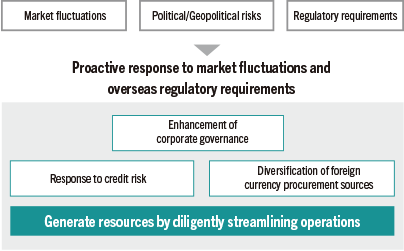

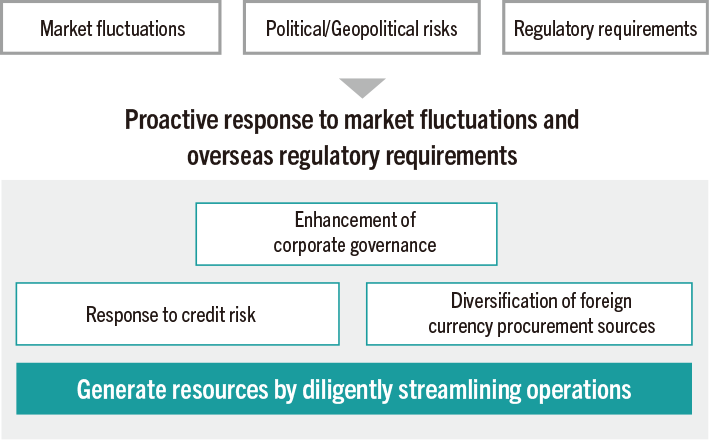

The Global Business Unit is looking to enhance its corporate investment banking business, which merges its banking business with its securities business. To this end, we will fully capitalize on Group strengths, such as our product/sector expertise and global network, in order to bolster our ability to provide integrated, group-wide solutions. Furthermore, we will develop multi-faceted business relationships by addressing customers’ business issues, as well climate change and other social issues, through our expertise in areas such as sustainable finance, M&A advisory, and payment services.

We will also pursue initiatives aimed at improving profitability that do not require us to significantly expand our balance sheet. Efforts to this end will aim to increase efficiency in terms of both capital and assets, for example by adopting a rigorous focus on profitability and strengthening our asset-turnover-based businesses’ focus on customers’ investment needs.