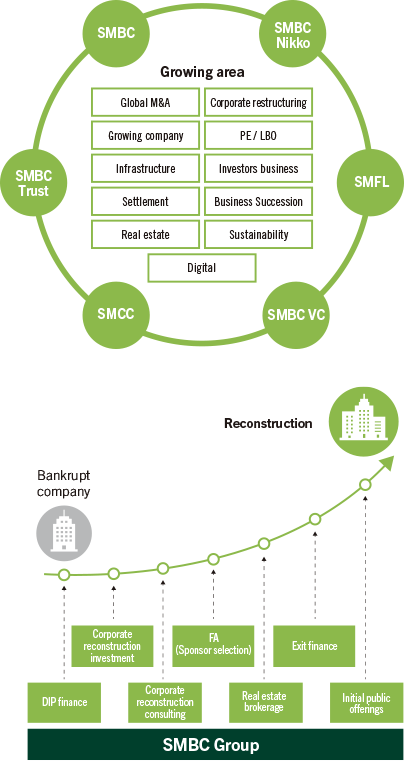

To bolster responsiveness to change in growth fields, a number of organizations were set up in the Wholesale Business Unit. Specifically, these organizations were the Financial Solutions Division, which specializes in financial products; the Sustainable Business Promotion Department, which focuses on environmental, social, and governance (ESG) issues and the United Nations Sustainable Development Goals (SDGs); and the Corporate Digital Solution Department. By uniting our front-office service, financial product, and solutions organizations in addressing customers’ various issues and needs, the Wholesale Business Unit will provide group-based comprehensive solutions.

In addition, we are developing systems for delivering swift and high-quality proposals to large corporations active on the global stage. As part of this process, we are enhancing our group-based competitive edge in response to increasingly complex and sophisticated management issues pertaining to such matters as business portfolio revision and global M&A activities.

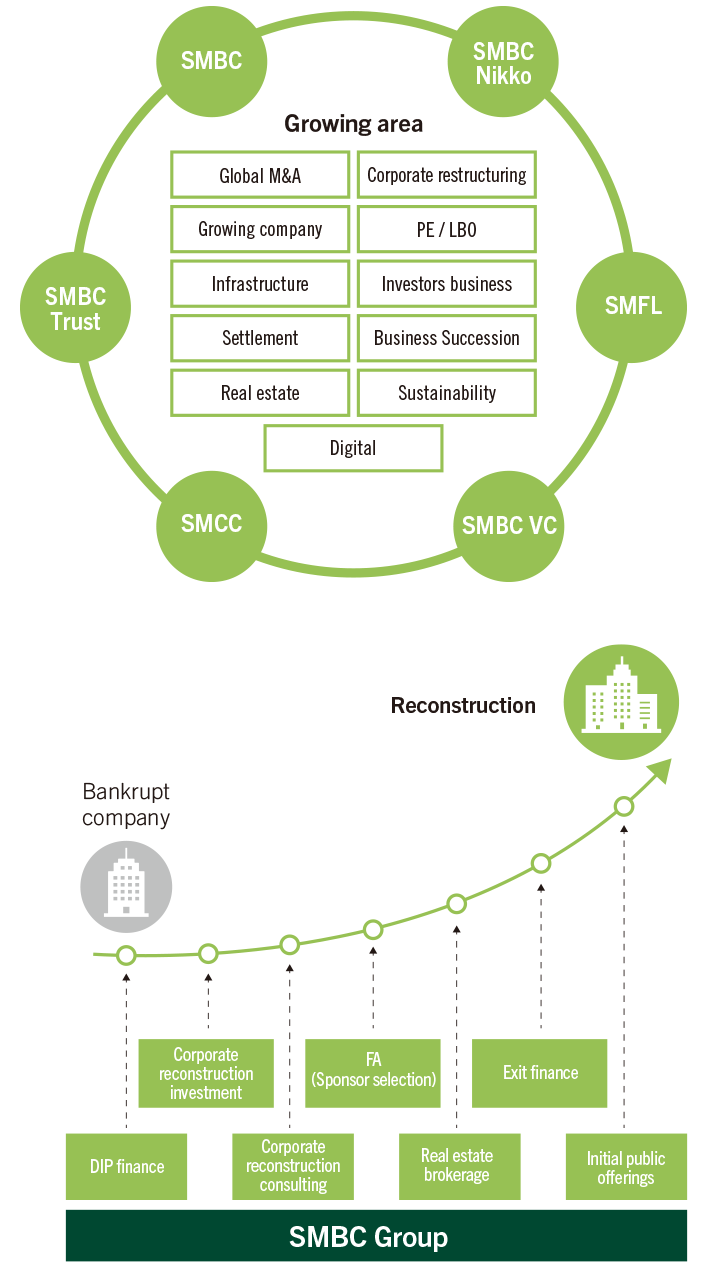

In Japan, corporate bankruptcies are on the rise, stimulating an increase in corporate restructuring needs. SMBC Group was a step ahead of the competition in developing a corporate restructuring business foundation to cater to these needs. On this front, we established SMBC Capital Partners Co., Ltd., a dedicated corporate restructuring support company, in February 2020, and this company is planning equity investments to the tune of ¥60.0 billion during the period of the new Medium-Term Management Plan. The Wholesale Business Unit views initiatives for improving the corporate value of customers and ensuring their business continuity as part of its value chain, and we will advance our corporate restructuring business on a group-wide basis accordingly.