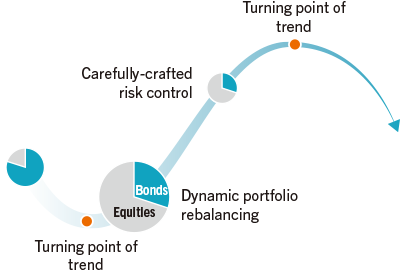

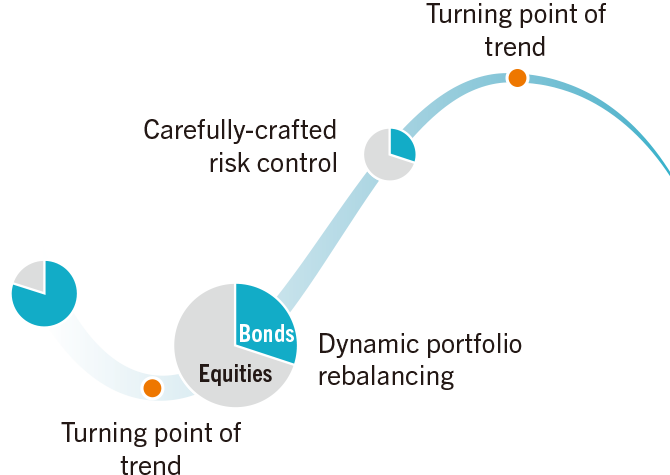

At the Global Markets Business Unit, we are constantly collecting and analyzing new information to fuel discussions and facilitate the formulation of various scenario projects. We thereby develop the capabilities to forecast the market trend in order to optimize our risk/return ratio. The dynamic and flexible operations of SMBC Group founded on proactive observation of market fluctuations are one of its strengths.

Looking ahead, it can be anticipated that globally low interest rates and technological progress will continue. In this environment, we will continue to manage assets in developed and other countries while exploring new revenue sources through means such as branching out into the bonds of emerging countries and other investment products and employing investment methods that take advantage of technologies.