In the Retail Business Unit, we revise resource allocations based on the growth potential of specific market segments. In regard to high-net-worth customers, we are strengthening sales capabilities through the consolidation of Group banking, trust, and securities services and appointing dedicated staff to increase our share of transactions from business owners and other wealthy large-scale clients. These efforts are part of our drive to promote the new SMBC Private Wealth service brand. Meanwhile, our approach toward the mass affluent segment, which is seeing growth in demand for asset building services, entails transitioning to highly productive sales approaches and models through digital and remote services promising significant convenience to customers, in order to efficiently capture a share of this vast, unexplored market.By expanding our balance of stock-based assets and radically increasing efficiency, we will achieve sustainable growth in wealth management business.

SMBC GROUP

ANNUAL REPORT 2020

Retail Business Unit

The top-class companies in banking, securities,

credit card, and consumer finance industries

that comprise the Retail Business Unit are

enhancing intra-Group coordination to address

the financial needs of all individual customers,

striving to develop the most trusted and No. 1

Japanese retail finance business.

Naoki Tamura

Senior Managing Executive Officer

Head of Retail Business Unit

We are witnessing significant opportunities for expanding markets in the domestic retail banking field, including the overarching trend of shifting from savings to asset holding, the upcoming era in which people consistently live to be 100, the spread of cashless payments, and increasing digitalization.

Against this backdrop, we are striving to become the most trusted and No. 1 Japanese retail finance business. To this end, the Retail Business Unit was swift to begin reforming its business models through means such as transitioning to a customer-oriented wealth management business and embracing cashless payments and digitalization. In our wealth management, payment service, and financing businesses, we are steadily growing balances of stock-based assets, sales handled, and consumer loans. Meanwhile, branch reorganizations are enabling us to realize improvements in customer convenience alongside reductions in costs. External institutions hold in high regard SMBC Group’s customer-oriented business operations as well as the smartphone applications of SMBC and Sumitomo Mitsui Card Company, indicating a gradual increase in our ability to achieve ongoing growth.

Under the new Medium-Term Management Plan, the Retail Business Unit aims to establish the most sustainable retail finance business in Japan. In our primary businesses, we are proactively allocating resources to growth markets, such as the cashless payment and consumer finance markets as well as those serving wealthy large-scale clients, as we seek to enhance the services we supply to customers and otherwise bolster competitiveness. At the same time, we are pursuing higher levels of efficiency in the branch reorganizations and administrative and middle- and back-office function consolidation efforts implemented previously. By drastically reforming our business processes through these efforts, we aim to further improve customer convenience while cutting costs. We are also endeavoring to develop new businesses utilizing digital technologies and IT in order to create new earnings opportunities amid intensifying competition, thereby realizing ongoing growth for the entire Retail Business Unit.

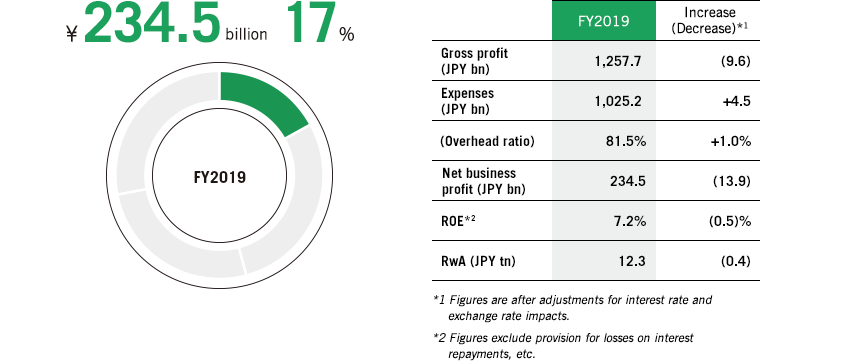

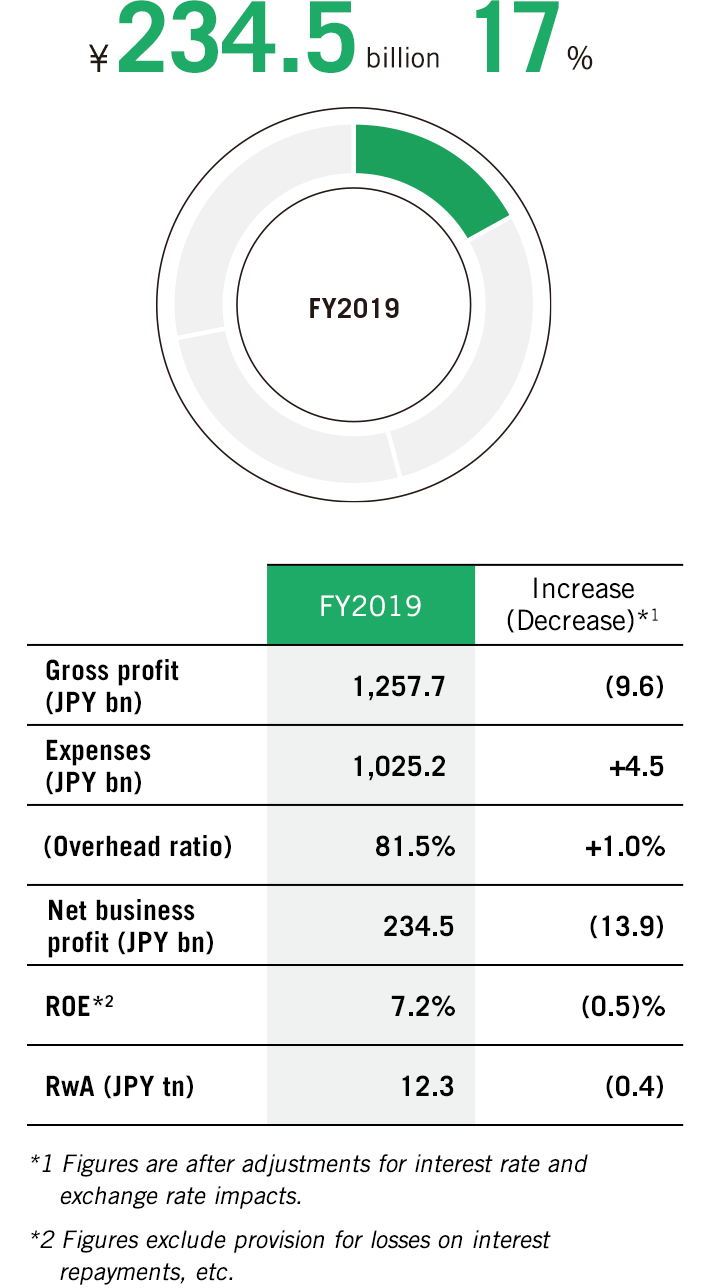

Contribution to Consolidated Net Business Profit

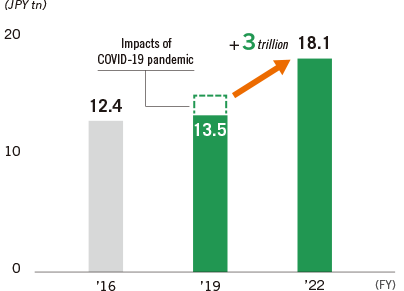

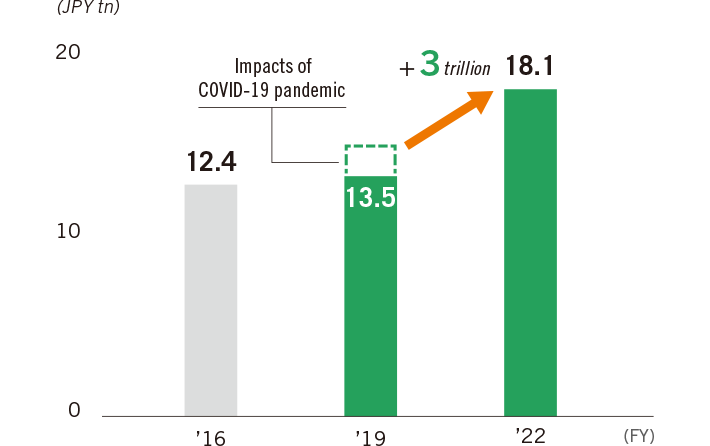

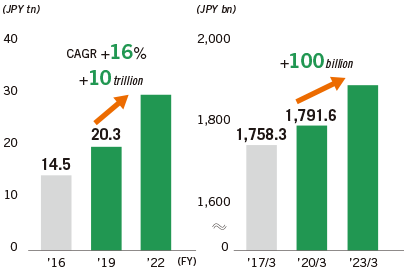

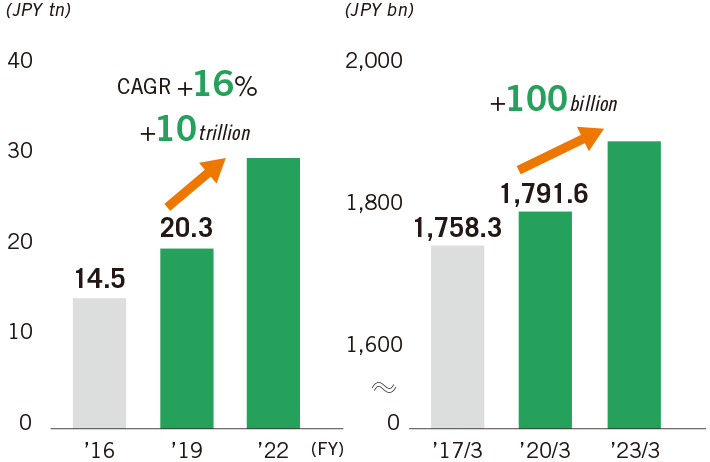

Sustainable Growth in Wealth Management Business

Sustainable Growth in Wealth Management Business

Balance of Stock-Based Assets

Pursuit of No. 1 Position in Payment Service Business

Pursuit of No. 1 Position in Payment Service Business

In our payment service business, we are committed to achieving growth that outpaces that of the market by accelerating cashless payment strategies and improving the convenience of our services for both business operators and users alike. For business operators, we have rolled out our stera next-generation cashless payment platform and are working to grow our share among affiliated merchants. For users, we aim to deliver convenient and beneficial services through means such as the enhancement of application services and the utilization of the Group’s shared V Point loyalty point system.

In the consumer finance field, a driver behind our growth, we are steadily addressing financing needs, which are rising in conjunction with the growth of cashless payment services. We also seek to approach the new customer segments born out of changes in the working population.

Sales HandledConsumer Loan Balance

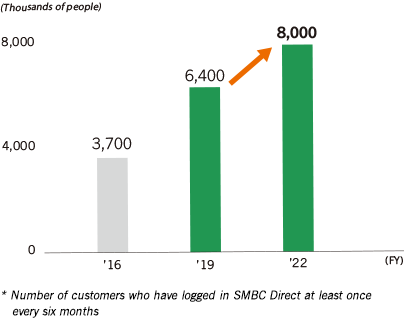

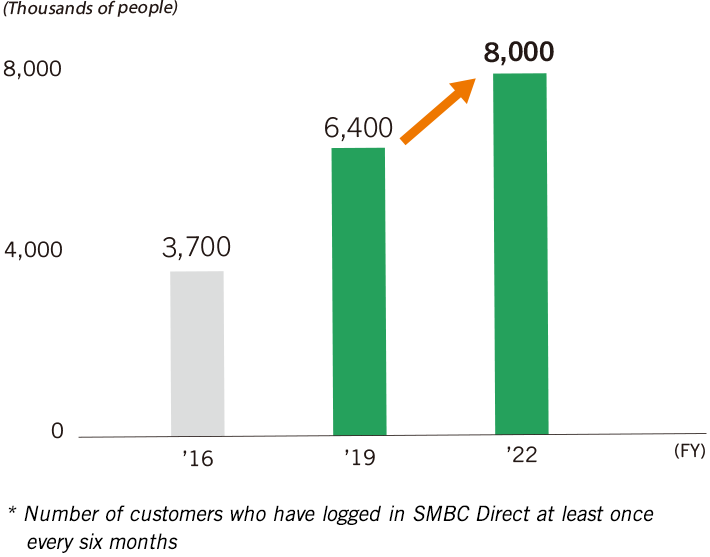

Online Merges with Offline Strategy

Online Merges with Offline Strategy

Points of contact with customers are rapidly shifting toward the Internet. In light of this trend, the Retail Business Unit is transitioning away from its prior business processes focused on face-to-face interactions to adopt business models oriented toward online interactions.

Part of this undertaking is streamlining work processes through extensive application of digital and remote technologies, which includes bolstering our artificial intelligence targeting and digital tools. We are also augmenting digital and remote channels in businesses that provide services to customers and coordinating these channels with face-to-face consulting in order to improve customer convenience in both online and offline settings.

Furthermore, improvements to the convenience of digital products and services will be pursued by linking Group applications and otherwise utilizing Group infrastructure, expertise, and resources.

Number of “SMBC Direct” Users*

Response to the COVID-19 Pandemic

The various measures being implemented to fight the COVID-19 pandemic are having a massive impact on people’s everyday lives. Moreover, we realize that financing, payment, and other services provided by financial institutions support people’s lives and are a part of social infrastructure. We therefore see the ongoing provision of these services as our top priority in the midst of this crisis.

In addition to keeping the branches of SMBC and other companies operating, we are taking steps to support customers based on their individual needs. For example, SMBC Group companies offer financial products specifically for customers who have been impacted by the pandemic. We are also bolstering our online services to enable customers to perform various transactions without actually visiting one of our branches. Other efforts include supplying Internet banking and credit card applications and conducting donation campaigns in which donations are made to healthcare professionals based on Internet banking transaction amounts.