Special Features:

SMBC Group’s Digital Strategies Transcending Finance

SMBC Group has defined the development of digital solutions for corporate clients as one of the key strategies of its Medium-Term Management Plan. This strategy is aimed at resolving the management issues of corporate clients and at creating new business value.

The forerunners of our digital strategies are SMBC CLOUDSIGN, Inc., and Plari Town, Inc. SMBC Group is encouraging in-house entrepreneurial ventures by supporting the ambitious and unprecedented undertakings of employees through a CEO production project. Both SMBC CLOUDSIGN and Plari Town, Inc., are led by CEOs in their 30s who have been appointed through this project.

In this feature, we look at the new endeavors of these two companies that break the mold of a financial group.

SMBC Group is keen to support the growth of SMEs by helping them address their operational streamlining issues with digital tools.

-

Ryo Namiki President & CEO

Plari Town, Inc. Ryo Namiki joined SMBC in 2008. After holding positions in corporate marketing, the Wholesale Banking Unit, and the Corporate Digital Solution Department, he became president & CEO of Plari Town, Inc., in May 2020.

Through partnerships between large and venture companies, we aim to provide new solutions that go beyond the traditional domain of banks.

-

Hideki Mishima President & CEO

SMBC CLOUDSIGN, Inc. Hideki Mishima entered SMBC as a mid-career hire in 2018. He was initially assigned responsibility for overseeing our digital innovation center, “hoops link tokyo,” and for developing new businesses. He became president & CEO of SMBC CLOUDSIGN in October 2019.

New Standard for Contracts

SMBC CLOUDSIGN

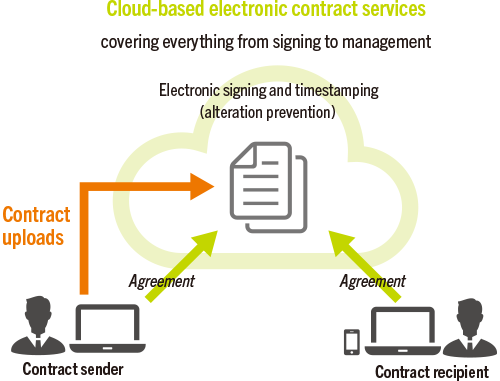

SMBC CLOUDSIGN was established in October 2019 as a joint venture between Bengo4.com, Inc., and SMBC Group to provide electronic contract services. Based on its business vision of transforming Japanese legacy cultures and business processes centered on contracts, this company supplies cloud-based electronic contract services that allow all aspects of contract conclusion, ranging from signing to storage, to be performed online. SMBC CLOUDSIGN’s services allow users to upload contracts for which negotiations have been completed to a cloud server, after which the counterparty can confirm and approve the contract online, resulting in its conclusion. This process expedites contract conclusion while reducing costs and making it easier to search for contract details.

The COVID-19 pandemic is spurring a shift away from traditional paper-based contract procedures, and cloud-based electronic contract services are gathering attention amid this transformation in traditional paper-based contract procedures.

Framework of SMBC CLOUDSIGN’s Services

Source of Competitiveness for Winning Out in the Electronic Contract Market

The electronic contract market is currently home to fierce competition stimulated by the increasing entry of new players. SMBC CLOUDSIGN is able to exhibit competitiveness in this market by capitalizing on its large market share and the reliability associated with the SMBC brand. The combined market shares of SMBC CLOUDSIGN and Bengo4.com make for the top share of the domestic electronic contract market. Furthermore, SMBC CLOUDSIGN can utilize SMBC Group’s base of corporate clients in its sales activities. This advantage makes it easier for SMBC CLOUDSIGN to approach large companies and those with long histories than it would be for a standard venture company. In this manner, the business of SMBC CLOUDSIGN will be advanced while coordinating with SMBC Group through means such as calling upon the Group’s marketing resources to conduct demand surveys of companies.

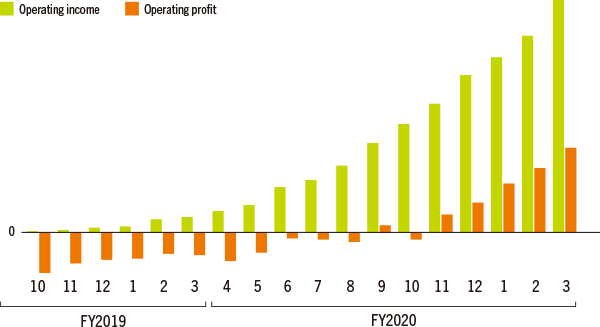

New Value Born Out of Partnerships between Large and Venture Companies

SMBC Group aims to become a global solution provider, and the accomplishment of that will require branching out from finance to resolve customer issues in their entirety. In this endeavor, partnerships between large and venture companies will be an important theme for creating new businesses based on ideas from employees. Through these partnerships, we aim to provide new solutions that go beyond the traditional domain of banks. SMBC CLOUDSIGN achieved profitability on a full-year basis in FY2020, a mere year and a half after its inception, with profit that erased the aggregate losses recorded thus far. One contributor to the company was the rise in attempts to move away from traditional paper-based procedures in response to the COVID-19 pandemic. SMBC CLOUDSIGN will continue building its track record in the pursuit of greater contributions to group-wide performance going forward as its management makes daily efforts to be an ongoing source of stimulation for employees as a successful case study for the CEO production project.

Operating Income and Operating Profit

Support for the Digitalization of Mid-Sized Companies and SMEs

Plari Town, Inc.

Plari Town, Inc., was established in May 2020. At the same time, this company launched its PlariTown corporate digital platform for supporting the digitalization efforts of mid-tier companies and small–medium enterprises (SMEs) in Japan. The full-fledged provision of services through this platform was commenced in December 2020.

PlariTown coordinates with not just SMBC Group services but also the business apps and services of partner service providers to provide individualized information and digital services matched to customer needs. These services exceed the boundaries of finance to contribute to increased competitiveness by addressing customer issues related to operational streamlining and other aspects of management.

PlariTown Service Examples

Comprehensive Supply of Digital Services Necessary for Daily Operation

When Plari Town President & CEO Ryo Namiki was working in corporate marketing at SMBC, he often fielded questions from customers about management issues related to operational streamlining. There was a limit to the extent to which the services offered by a bank could be used to address such customer issues. The desire to help resolve these issues was what led to the creation of Plari Town, Inc.

A major characteristic of the Plari Town digital platform of this company is how it spreads beyond the boundaries of financial services to offer various services for supporting daily operations, including accounting, marketing, human resource management, legal affairs, and planning services, on a one-stop basis. As the digitalization trend advances, SMBC Group is keen, as a global solution provider, to support the growth of SMEs by helping them address their operational streamlining issues with digital tools.

Development of a High-Value-Added Digital Platform

A major advantage at the time of the establishment of Plari Town, Inc., was the ability to assemble a team of human resources from both inside and outside of SMBC Group. From SMBC Group, individuals with highly specialized knowledge pertaining to legal affairs, taxation, IT, and other subjects were called. Meanwhile, project members were recruited from among like-minded individuals at various outside partner companies. Having an environment conducive to such a project is a valuable asset to SMBC Group. The thinking and speed of outside partners also helped inform various steps of the process. Such outside perspectives are something to be incorporated into SMBC Group going forward. Plari Town, Inc., will continue to coordinate with various internal and external organizations to heighten value and develop a digital platform for the entire Group.