Shareholder Return and

Dividend Information

Enhancing Shareholder Returns

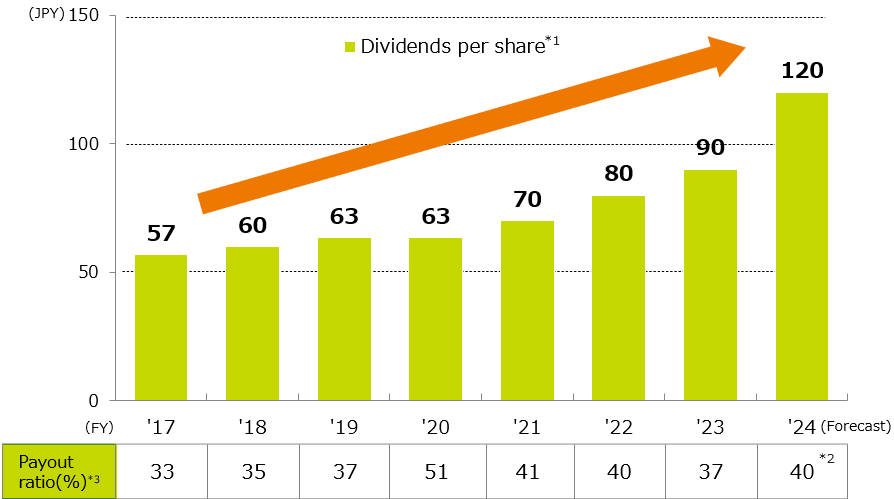

Dividends will be our principal approach for shareholder returns. In addition, we will proceed with share buybacks on a flexible basis.

We aim to maintain our progressive dividend policy and dividend payout ratio of 40% while increasing our dividend payouts by increasing bottom line profit.

Also, we will execute share buybacks taking into account the factors such as our capital position, earnings trends, stock price, growth investment opportunities and an improvement of capital efficiency.

Dividend Information

| FY3/25 | |

|---|---|

| Dividends per Share (Yen)(Common stock) | 122 *1,2 |

| Per Share (Yen): Net income | 301.55 |

| Per Share (Yen): Net assets | 3,795.62 |

| Consolidated payout ratio (%)(common stock) | 40.3 |

- *1 Of which, 45 yen was paid as interim dividends

- *2 Amount adjusted retrospectively, based on the stock split (3-for-1) implemented on October 1, 2024

Historical Per Share Data

| FY3/21 | FY3/22 | FY3/23 | FY3/24 | |

|---|---|---|---|---|

| Dividends per Share (Yen)(Common stock) | 63 | 70 | 80 | 90 |

| Per Share (Yen): Net income | 124.75 | 171.84 | 196.82 | 241.52 |

| Per Share (Yen): Net assets | 2,876.58 | 2,941.84 | 3,143.51 | 3,719.12 |

| Consolidated payout ratio (%)(common stock) | 50.8 | 40.7 | 40.4 | 37.1 |

Dividends per share

- *1 Amount adjusted retrospectively, based on the stock split (3-for-1) implemented on October 1, 2024 (rounded to the nearest whole number)

- *2 Calculated based on fiscal 2025 consolidated net income forecast (¥1,500 billion) and dividend forecast (¥157 per share)

- *3 Consolidated payout ratio

Switch to Japanese

Switch to Japanese