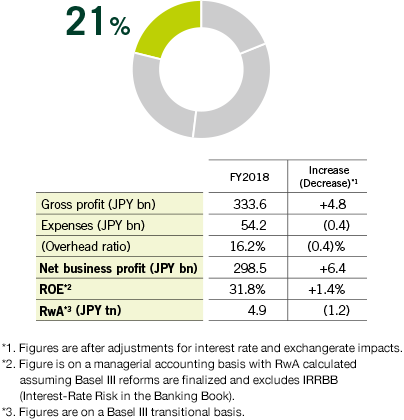

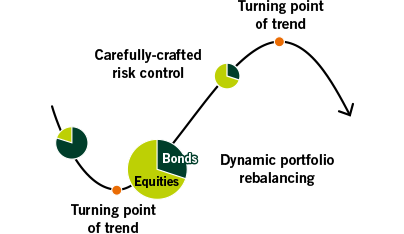

In FY2018, we achieved earnings amid a volatile operating environment by rebalancing risks associated with the increasing severity of the trade disputes between China and the United States and by implementing other flexible portfolio management measurements. As a result, net business profit grew by ¥6.4 billion, to ¥298.5 billion, and ROE was 31.8%.

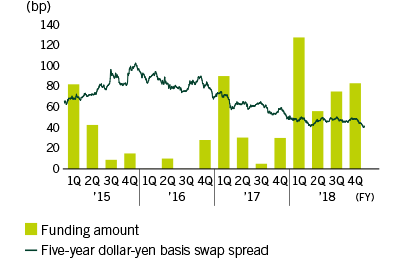

In sales and trading, foreign exchange-related transactions were brisk. These brisk transactions were a reflection of our ability to solicit transactions from various customers by responding to diverse customer needs with high-quality solutions proposals.