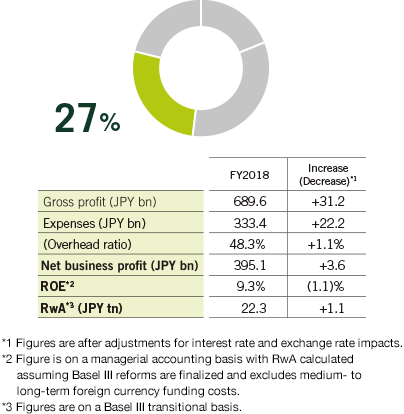

The highly volatile market of FY2018 led to our securities businesses underperforming, and we also booked one-time expenses associated with Brexit and the merger of BTPN and SMBCI. Nonetheless, growth was achieved in deposits, foreign exchange, derivatives, and other non-asset-based profits. In addition, we were able to progressively move forward with priority strategies pertaining to initiatives such as the implementation of asset-turnover based business models. As a result, net business profit in FY2018 rose ¥3.6 billion, to ¥395.1 billion, and ROE was 9.3%.

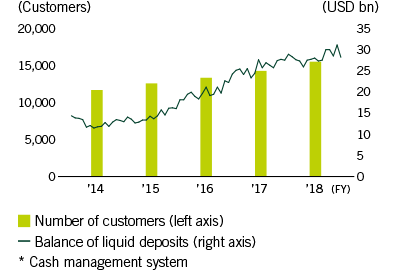

Furthermore, we were able to maintain the balance of foreign currency deposits, a key prerequisite for sustainable growth, at a high level of approximately US$200 billion, while also improving the quality of those deposits.