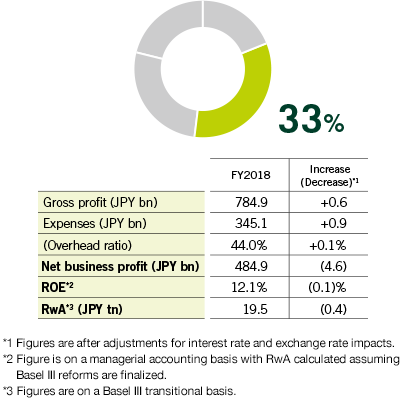

In FY2018, high levels of net business profit and ROE were achieved with figures of ¥484.9 billion and 12.1%, respectively. This achievement can be attributed to higher non-interest income at SMBC following profit structure reforms as well as growth in the investment bank operations of SMBC Nikko Securities. These factors counteracted the decline in domestic loans and investment management income at SMBC that was a result of Japan’s negative interest rate policy and intense competition.

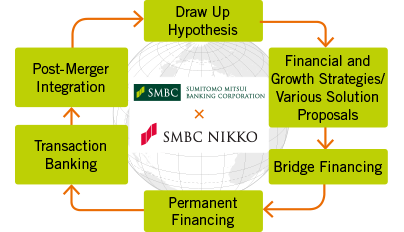

In addition, we were No. 1 in terms of the number of M&A advisory deals for the second consecutive year and also became No. 1 in the number of initial public offerings in which we were the lead underwriter. These accomplishments indicated the steady growth of the Wholesale Business Unit’s underlying strength.