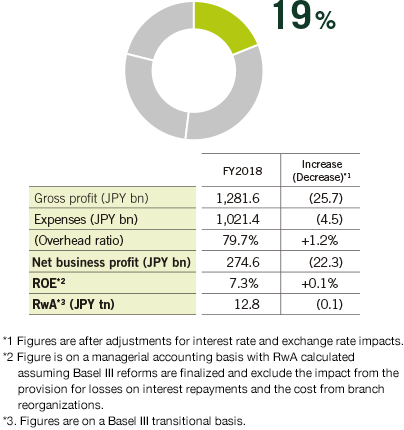

Our credit card and consumer finance businesses performed favorably with growth in sales handled exceeding the industry average coupled with success in capitalizing on the healthy capital needs of individual customers. Conversely, the wealth management business suffered a year-on-year decline in profit due to low appetites for investment amid a sluggish market. As a result, net business profit in the Retail Business Unit decreased ¥22.3 billion, to ¥274.6 billion, while return on equity (ROE) declined to 7.3%. Nevertheless, our customer-oriented wealth management business initiatives, cashless payment strategies, and branch reorganizations drove steady increases in the underlying strength that supports ongoing profit growth.

The top-class companies in banking, securities, credit card, and consumer finance industries that comprise the Retail Business Unit are enhancing intra-Group coordination to address the financial needs of all individual customers, striving to develop the most trusted and No. 1 Japanese retail finance business.

With a wide range of businesses encompassing wealth management, cashless payments, and consumer finance, the Retail Business Unit boasts the No. 1 operating foundation in Japan. After the introduction of the group-wide business units, we were quick to conduct business model reforms, including those related to customer-oriented business operations and digitalization. The benefits of these efforts are steadily emerging in the forms of improved customer convenience and reformed cost structures.

Currently, changes in society are giving rise to business opportunities, such as the new financial needs appearing as the era of the centenarian approaches and the Japanese government’s push to promote cashless payments.

Faced with these changes in the operating environment, the Retail Business Unit continues to advance cutting-edge business model reforms based on the key themes of “customer oriented” and “digitalization.”

Review of FY2018

Contribution to Consolidated Net Business Profit

Priority Strategies

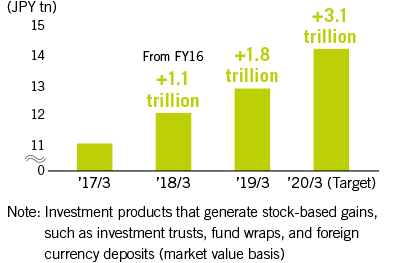

Wealth Management Business

In the wealth management business, we continued to promote the transition to a customer-oriented wealth management business throughout FY2018. Our goal in this area is to develop a sustainable, customer-oriented business and stabilize profits by providing medium- to long-term diversified investment proposals that respond to customers’ need to protect and increase their assets.

The senior citizen market is anticipated to grow in the upcoming era in which people consistently live to be 100. We therefore intend to augment our ability to respond to the long-term wealth management, inheritance, and succession needs seen in this market.

Balance of Stock-Based Assets

(SMBC and SMBC NIKKO)

Cashless Payment Strategies

The Retail Business Unit looks to grow its market share through the full-fledged implementation of cashless payment strategies. For example, U.S. partner Square, Inc., has developed a cashless payment service with a simple and intuitive interface. We will focus on increasing the number of small and medium-sized enterprises that handle this service by utilizing SMBC’s customer base.

In addition, we renovated our smartphone application in FY2018. We are now focused on the enhancement of user services, with regard to which we have begun offering on-the-spot issuance of debit cards, use limit settings, and household budget management functions.

Payment Service Using Square’s Card Reader

Branch Reorganizations

Over the past two years, SMBC has transformed 259 of its 430 branches into next-generation branches. The goal of our reorganizations is not to reduce the number of branches, but rather to maintain our network, which furnishes our points of contact with customers, while cutting costs at branches. We are also reforming our ATM network to better accommodate customer needs. In September 2019, we plan to make it possible for customers of both MUFG Bank, Ltd., and SMBC to use the same off-site ATMs (ATMs in unstaffed locations other than branches and convenience stores).

Another area of focus is enhancing the functionality and user interface of our smartphone application. To this end, we are utilizing the input and requests garnered from customers through our various contact points to develop optimal services.

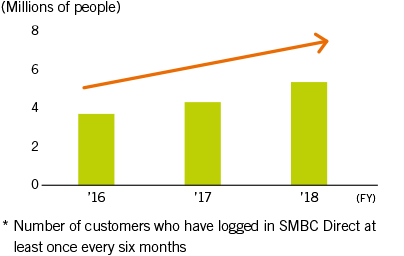

Number of “SMBC Direct” Users*

Initiatives for Accomplishing Sustainable Development Goals

Opportunities for Investment in Environmentally and Socially Minded Companies

SMBC Nikko Securities handles investment trusts emphasizing environmental, social, and governance (ESG) factors to provide customers with opportunities for investment in environmentally and socially minded companies. In addition, SMBC began offering the World Impact Investment Fund that invests in companies boasting innovative technologies or business models.

Through these and other initiatives, SMBC Group is supporting companies intent on accomplishing the United Nations Sustainable Development Goals.