Opening up the Future of Finance through Digital

Leveraging Digital to Provide New Solutions

In recent years, the advance of digitalization, coupled with the COVID-19 pandemic, has led to the transformation of society and the economy.

SMBC Group’s medium to long-term vision is to become “A trusted global solution provider committed to the growth of our customers and advancement of society,” and we have been developing and improving various services to respond to customers’ needs.

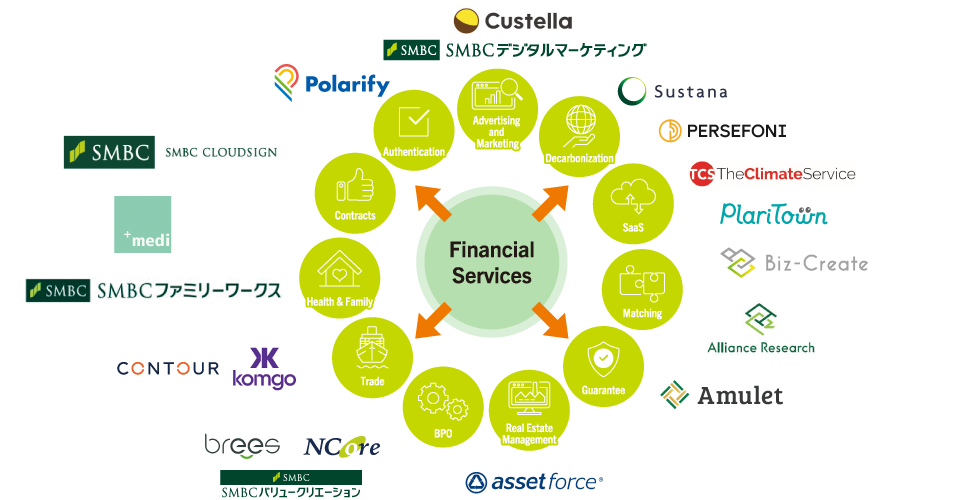

In all areas of its business, SMBC Group is creating added value through new services and the evolution of existing services by incorporating technologies, sometimes together with partner companies, with the aim of improving convenience for its customers.

As a result, the Group is not confining itself to finance in the digital space, it is also expanding into non-finance business areas, as we transform into a comprehensive solutions provider through the creation of a number of digital subsidiaries and new digital services.

Going forward, we will continue to leverage the trust held in SMBC Group and its customer base to develop new business areas, taking advantage of opportunities presented by structural changes in society and deregulation brought about by the spread of digital, while promoting a shift in mindsets within the company and the creation of a framework that facilitates innovation.

Growth and Future Outlook for SMBC Group’s Digital Business

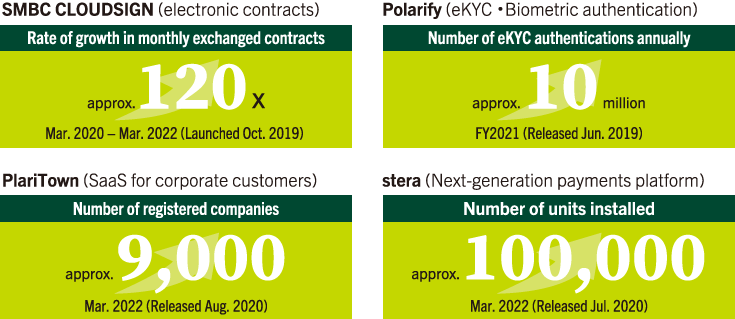

SMBC Group’s digital business has experienced substantial growth, driven by a tailwind from the rapid digitization of society spurred by the COVID-19 pandemic, and some of its services are becoming social platforms.

SMBC CLOUDSIGN, an electronic contract service established as a joint venture with Bengo4.com in 2019, has seen approximately 120 times growth in the number of contracts exchanged in March 2022 compared to the same month two years ago. The fact that this system is used by SMBC Group, a financial institution with high security standards, has led to customer trust in the service, which has entered widespread use among companies, regional financial institutions and local public bodies.

Established in 2017, Polarify, which offers eKYC (online identity verification) and biometric authentication services, has seen a steady increase in the number of customers since its establishment, as it has met the needs of corporate customers seeking to acquire customers online against the backdrop of the spread of smartphones and other factors. Polarify’s eKYC service has now grown to reach more than 10 million authentications each year.

In less than two years since its launch in August 2020, the number of members of “PlariTown” corporate SaaS platform has increased to approximately 9,000 companies, and is supporting corporate customers in resolving a wide range of management issues. In addition, the number of installations of Sumitomo Mitsui Card Company’s next-generation payments platform “stera” has grown to more than 100,000 units in the space of approximately 20 months following its release in July 2020. As a further development, in May 2022 we released “assetforce for stera,” combining “stera” with “assetforce,” a smartphone-based asset management service provided by Sumitomo Mitsui Finance and Leasing, to support the digital transformation of store management, including the warehousing of goods and inventory management. As these initiatives show, SMBC Group continues to expand its digital service offerings through the creation of new services and collaboration between Group companies.

Using Financial Data to Create New Value

We are also actively engaged in non-financial businesses that utilize data. In July 2021, SMBC Digital Marketing was established as a joint venture with Dentsu Group to launch an advertising and marketing business leveraging the financial data held by SMBC Group.

The company’s advertising and marketing business is able to estimate the attributes of individual customers, their willingness to spend, life events etc., based on data associated with the 28 million IDs held by SMBC. Analysis of this data can deliver advertising tailored to customer needs. In supporting sales growth for corporate customers and providing individual customers with the opportunity to encounter valuable products, this will provide new value not found in conventional financial institution services.

The service has begun with banner advertising displayed within the Sumitomo Mitsui Banking Corporation application, and we have received advertising orders from customers such as cosmetics companies, publishing companies, retailers and security companies, and have achieved positive results both in terms of the number of impressions and click-through rate. We will continue to improve our services as we make further achievements.

As an advertising and marketing service provided by a financial institution, this business attaches utmost importance to the safety and security of our customers. For this reason, personal information is strictly managed, and we conduct regular monitoring with the involvement of outside experts such as lawyers.

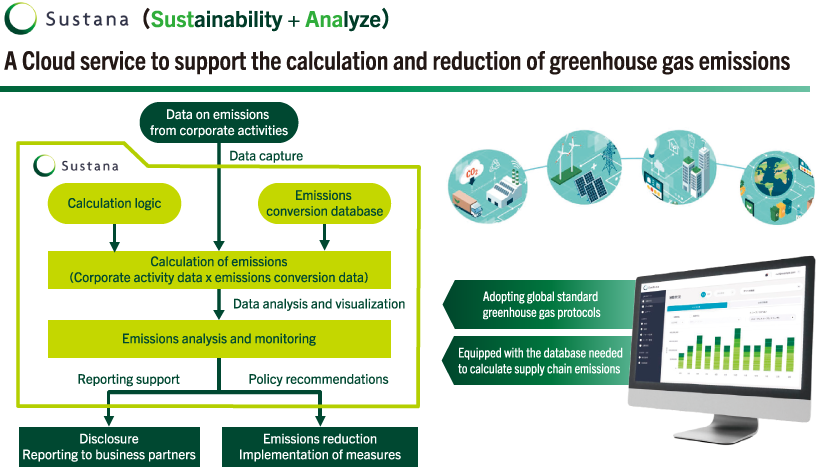

Leveraging Digital to Solve Social Issues

Another example of non-financial business expansion through digital is the Group’s provision of solutions to help companies implement decarbonization management. Society has grown increasingly aware of climate change in recent years, and it is essential that our corporate customers work towards achieving a decarbonized society. To do so, they must collect and analyze a great deal of data in order to visualize greenhouse gas emissions and plan measures to reduce those emissions.

SMBC Group plans to provide digital support from the collection and visualization of needed data to information disclosure and matching with companies that possess the technologies underpinning measures to reduce emissions. Specifically, in May 2022, we developed and released in-house “Sustana,” a tool for calculating greenhouse gas emissions using digital technology. SMBC Group has also begun offering the Climanomics® platform in partnership with IBM Japan, and The Climate Service. It is a cloud service for quantifying the financial impact of natural disasters and other events caused by climate change and supporting responses to the TCFD recommendations and other disclosures.

These businesses are new enterprises created from a focus on the affinity between digital and decarbonization initiatives, requiring the collection and analysis of large volumes of data to formulate measures. We plan to provide additional related services in the future. We will contribute to solving social issues such as climate change utilizing digital technology.

Responding to the Ongoing Shift to Digital in BtoB Transactions

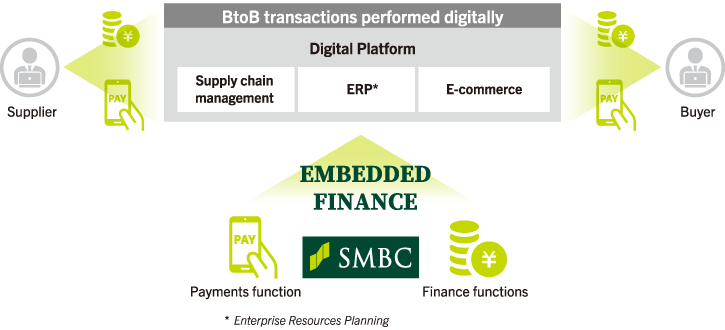

The presence of platforms digitizing transactions between suppliers and buyers has been growing rapidly in recent years, especially overseas. Financial institutions are increasingly moving towards so-called “embedded finance,” which provides flexible payments and financing to a wide range of companies along distribution channels through partnerships with platforms providing digital services.

SMBC Group is also actively collaborating with leading platformers to develop and advance services in a way that provides seamless financial solutions for business-to-business transactions. For example, in March 2022, we released a digital scheme for supply chain financing in the APAC region to address suppliers’ early-stage capitalization needs. Traditionally, it took several business days from the receipt of a supplier’s request to the execution of financing due to the many paper-based interactions required, but by leveraging digital, high-volume transactions can now be completed in a matter of minutes. Beginning from this, we will continue to connect with various platforms, and will also consider digitalization of services for order and supply processes and for day-to-day management of receivables and payables. We are contributing to the advancement of our customers’ supply chain management not just through banking transactions, but also by supporting the digital transformation of their entire supply chains to connect the flows of goods, money and data in real time.

The emergence of digital platforms in BtoB transactions has been limited in Japan compared to overseas, but the digitalization of BtoB transactions is making headway, prompted by revisions to the Law on Book and Record Keeping through Electronic Methods and the abolition of promissory notes. We intend to respond flexibly to these changes within Japan.

Initiatives to Enrich Lives Using Digital Technology

We have started to offer digital services catering to life events to enrich people’s lives through digital technology.

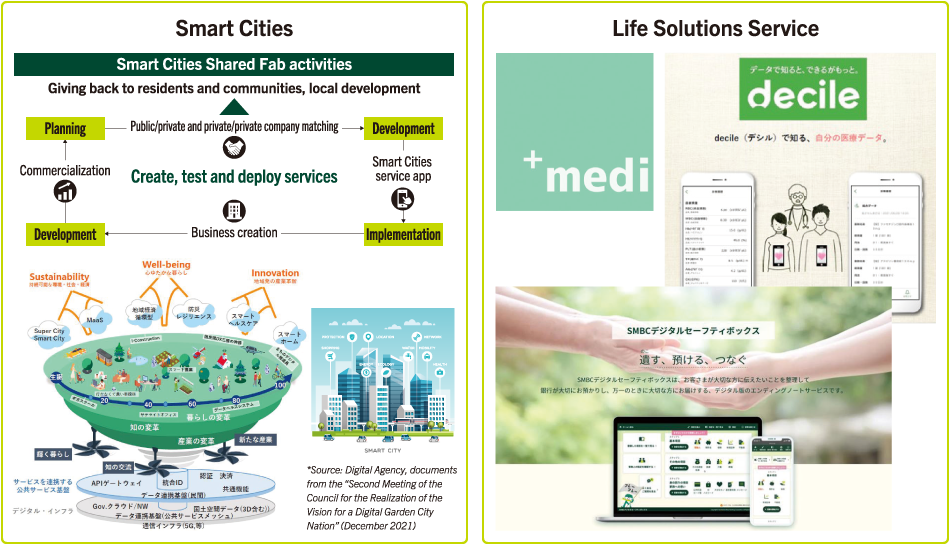

In order to safely and securely store personal data, promote its use, and enrich the lives of individuals, we have been working on the creation of an information bank handling medical data through a proof-of-concept experiment with Osaka University Hospital in 2019, and by making Plus medi corp a consolidated subsidiary in 2020.

We have released the “SMBC Digital Safety Box,” which digitally records and stores information and instructions on assets, medical and nursing care, as well as funeral arrangements to be communicated to pre-registered individuals in the event of unexpected circumstances.

In May 2022, with a view to achieving well-being and a sustainable society, NEC Corporation and SMBC Group together established the “Smart Cities Shared Fab” to accelerate efforts to implement smart cities, i.e., the digital transformation of society as a whole. The consortium aims to overcome hurdles in planning, developing, and implementing services and the lack of a system that enables sustainable operation, which constitute challenges to the spread of smart cities, and to go beyond proof-of-concept to achieve social implementation. We are also expanding our life solutions service initiative to include smart cities, and are working to enrich the lives of urban residents.

Creating Mechanisms to Generate New Innovations

We are not only creating new digital businesses, we are also working to change the mindset within the Group and create a framework that facilitates innovation.

At our hubs in Silicon Valley in the U.S. and Shibuya in Tokyo, we are working to create new innovations by deepening exchanges with external groups including startups and venture capitalists.

The Group has also established a support system to help bring ideas to fruition by drawing on resources such as CDIO meetings which make investment decisions for new digital businesses. At the same time, we are working to create an environment that makes it easier for employees to come up with ideas, and to materialize and commercialize those ideas through “Midoriba,” the Group’s internal social networking site and “D X-Link,” an owned media for sharing information on SMBC Group’s philosophy and digital-related initiatives, and “Digital University” a digital training program.

New intrapreneurial ventures to drive non-financial digital solutions established under the “Producing New CEOs” initiative have selected young employees as their presidents, and are now actively allocating personnel. A young female employee has been appointed president of SMBC Family Works, a newly established digital family support service established in April 2022. Financial institutions must change to keep pace with the rapidly changing society. By instilling this kind of structure and culture, SMBC Group will continue to innovate tirelessly and grow together with its customers and society.