Creating Value through Sustainability Initiatives

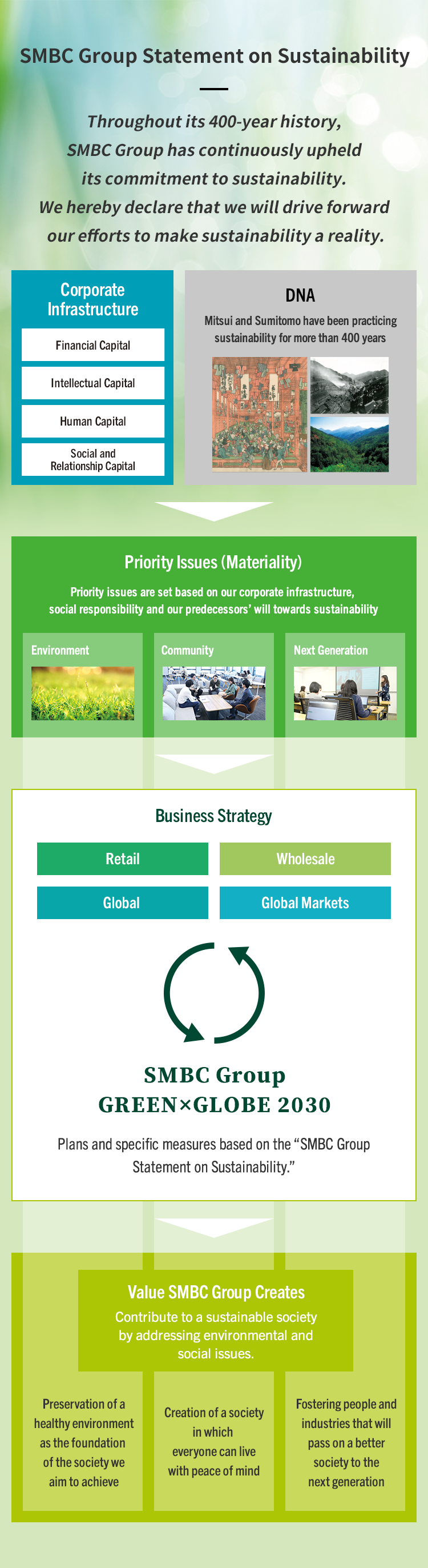

SMBC Group positions sustainability at the core of its management and is implementing business strategies that focus on three priority issues: Environment, Community, and Next Generation.

We are contributing to bringing about a sustainable society while working to maximize social and economic value through our business activities.

Governance Structure to Realize Sustainability

SMBC Group has established the Sustainability Committee and the Corporate Sustainability Committee at the supervisory and executive levels, respectively, to achieve ongoing enhancement of sustainability management.

Under the oversight of the Group CSuO, the Sustainability Division, responsible for the planning and promotion of both corporate and business aspects, was established in April 2022 to consolidate functions and knowledge at the group level.

from Group CSuO

from Group CSuO

Achieving sustainability of course requires the protection of our irreplaceable environment and the creation of a society in which everyone can live with peace of mind, but a sustainable economy responsible for the circulation of capital and resources is also necessary. I believe that as a company, sustainability management is the act of balancing the resolution of social issues and creating and returning economic value, that is, to make the environment, society and economy all sustainable. As the Group CSuO, my responsibility lies here.

SMBC Group has identified “Environment,” “Community,” and “Next Generation” as its priority issues (materiality) in the execution of sustainability management, and is striving to resolve social issues through its business activities. For the “Environment,” we are committed to achieving net zero emissions across our entire loan/investment portfolio by 2050, and the Group as a whole is striving to support our customers’ efforts in the transition to a decarbonized society. We are also being proactive in the stabilization of natural capital, represented by forestry and water resources, and to conserve biodiversity.

Mitsui and Sumitomo’s predecessors have practiced sustainability for more than 400 years through their businesses. As the Group CSuO, I will further accelerate SMBC Group’s sustainability initiatives to pass on a sustainable society to the next generation.

Fumihiko ItoGroup CSuO

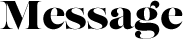

SMBC Group GREEN×GLOBE 2030

Based on the “SMBC Group Statement on Sustainability,” the following basic concept and three pillars of the plan define specific measures to be taken by 2030, including the execution of finance that contributes to the realization of sustainability and the provision of financial literacy education.

“GREEN” represents our corporate color and the environment while “GLOBE” represents the earth and a borderless world. The two terms are connected by “×” to show the plan’s expansion through multiplication rather than mere addition.

Through the steady implementation and monitoring of the plans and measures set out in “SMBC Group GREEN×GLOBE 2030,” we will strive to bring about the society we aspire as we enhance our internal and external sustainability efforts.

Environment

The global environment is an asset shared by all of humanity, regardless of region or age, and a healthy environment is an essential prerequisite to the realization of a sustainable society. SMBC Group is taking climate change and various other environmental issues seriously. By taking part in resolving such issues through our core business activities, we are stressing the importance of passing on a healthy planet to future generations.

For example, accelerating the transition to a decarbonized society in Japan and around the world, requires the further promotion of renewable energy, ensuring stable energy supplies, and next generation technological innovation.

Given this backdrop, SMBC Group is making group-wide efforts in conducting environmental business, including project finance for renewable energy, underwriting green bonds, trusts and leases for solar power generation facilities, and TCFD compliance consulting.

Under the title “SMBC Group GREEN Innovator,” we are also focusing on developing and providing advanced services, including non-financial services, by consolidating expertise and information on sustainability from across the group as well as collaborating with other industries.

By providing these groupwide solutions, we will comprehensively support our customers’ environmental initiatives and develop environmental businesses offering both economic and social value.

Project Finance for Green Hydrogen

In September 2021, in French Guiana, SMBC became the first bank in the world to provide project finance for a renewable energy development project utilizing green hydrogen.

Green hydrogen is hydrogen produced without carbon dioxide emissions during the process of its manufacture, such as by using solar power. SMBC is the only commercial bank outside of France to participate in this project.

Digital Tool to Support Financial Impact Analysis and Disclosure Consistent with the TCFD Recommendations

In May 2022, SMBC released the Climanomics® platform, a digital tool to help customers comply with the TCFD recommendations.

This cloud service supports the formation of climate change strategy and disclosure by quantifying the financial impact of risks and opportunities associated with climate change.

SMBC is providing this service through a three-way collaboration with The Climate Service in the United States and IBM Japan.

Efforts Addressing Climate Change

SMBC Group is supporting customers’ efforts to realize, and transition to, a decarbonized society, in order to reduce greenhouse gas emissions in line with the targets set by the Paris Agreement.

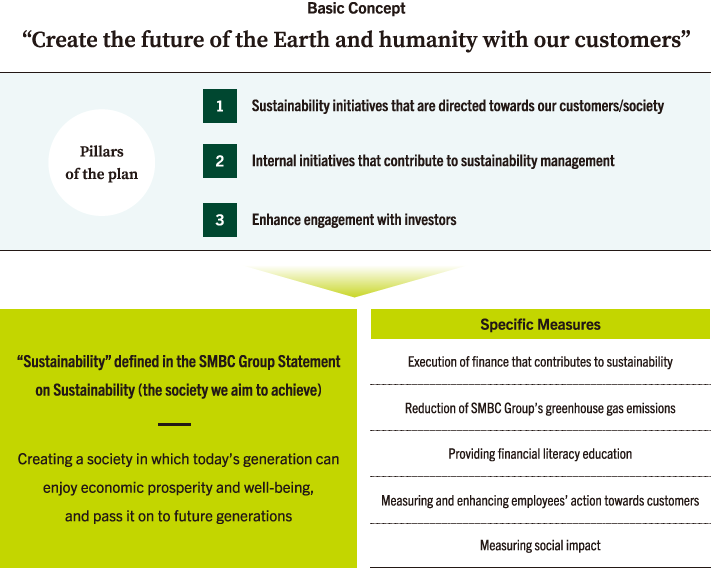

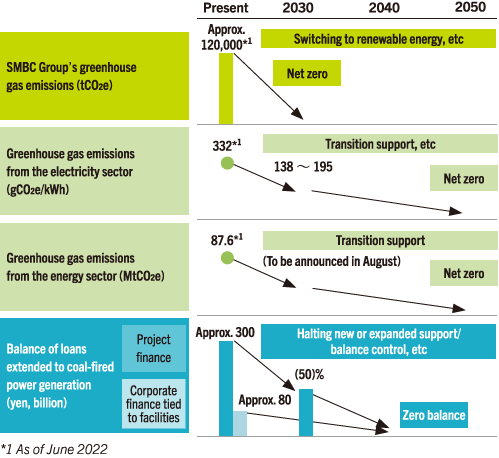

Against this backdrop, SMBC Group has committed to achieving net zero greenhouse gas emissions by 2030, as well as net zero greenhouse gas emissions for its entire loan/investment portfolio by 2050.

In order to achieve this commitment, we are reinforcing our efforts to address climate change through the “Roadmap Addressing Climate Change,” a long-term action plan targeting carbon neutrality by 2050, and “Action Plan STEP 1,” a package of specific measures to be undertaken and executed during the current Medium-Term Management Plan period.

While strengthening our activities based on the Roadmap Addressing Climate Change, we will accelerate efforts to achieve a decarbonized and sustainable society by engaging carefully with our customers and other stakeholders and create a shared understanding regarding climate change issues.

Initiatives to reduce greenhouse gas emissions

In order to reduce its own greenhouse gas emissions (Scopes 1 and 2), SMBC Group is shifting its electricity usage to renewable sources, and since April 2022, four of its headquarter buildings (Head Office, East Tower, Osaka Head Office, Kobe Head Office) have all switched to renewable energy. In addition, SMBC Kawasaki Mega Solar Place, the first mega solar generation facility for a megabank, is to be built on vacant land owned by the Group. From April 2023 onward, SMBC Group plans to switch to renewable energy sources for electricity used in all of its own buildings in Japan and in the headquarter buildings of all major Group companies in Japan. Going forward, we will further accelerate our initiatives at the Group and Global level.

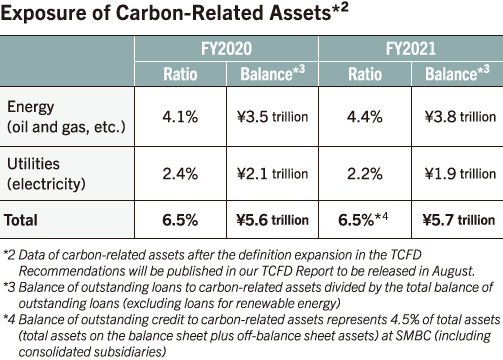

As a financial institution that supports the business of our customers and prospers together with them, one of our important missions is to support our customers’ efforts to decarbonize their businesses, which is a major challenge to achieving sustainability. As part of our effort to reduce greenhouse gas emissions in our loan and investment portfolio, in May 2022, we announced a target to reduce carbon intensity of the power sector to 138-195g CO2e/kWh by 2030. We will publish greenhouse gas emission reduction targets for the energy sector (oil and gas, coal), in the TCFD Report to be issued in August 2022. In addition, we expanded the scope of the existing zero balance target of loans extended to coal-fired power plants by 2040, to include corporate finance tied to facilities.

SMBC Group is a member of the Net-Zero Banking Alliance (NZBA), an international banking initiative aiming to achieve net zero emissions, and the Net Zero Asset Managers Initiative (NZAMI), a net zero initiative for asset managers, and is involved in global discussions and the creation of various types of guidance to realize a decarbonized society. We believe that our role as a responsible financial institution is to carefully draw and support a path towards a decarbonized society together with our customers, and SMBC Group will earnestly support our customers’ transitions while setting ambitious goals to achieve net zero emissions by 2050.

Climate Change Risk Management

Enhanced Scenario Analysis

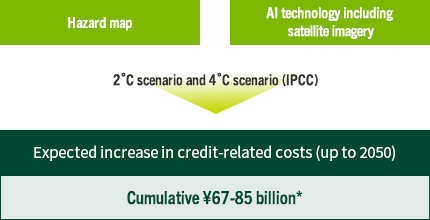

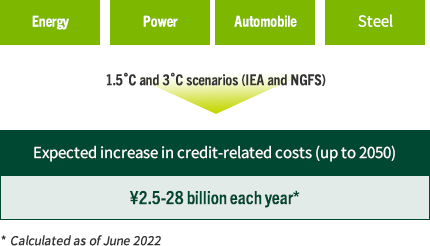

In order to understand and manage the financial risks associated with climate change, we conduct scenario analyses of physical and transition risks.

For physical risks, we estimate additional credit-related costs arising from SMBC’s lending to corporate customers by calculating the expected depth and the probability of flooding under each climate change scenario for water-related disasters, which account for the majority of natural disasters resulting from climate change.

Global impact analysis is made possible through an AI technology owned by a startup in the United States as well as collaboration with a research institution in Japan.

For transition risks, we estimate additional credit-related costs arising from lending to sectors that are expected to be highly impacted by the transition to a decarbonized society, using the most recent scenario in which the rise in temperatures is estimated to be 1.5°C.

Through sophistication of analysis methods and expansion of target sectors, SMBC Group will more accurately deduce financial impacts associated with climate change, and use this information to enhance company-wide risk management.

Physical risks

Transition risks

Risk Management in Investment and Lending

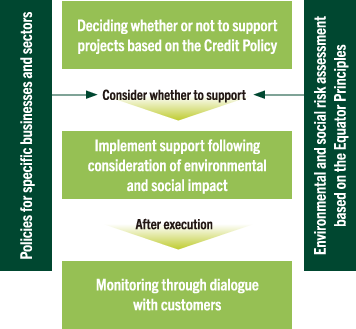

We have established a framework for due diligence for the appropriate management of environmental and social impact through our business. Specifically, we are managing credit with the potential impact through environmental and social risk assessments based on the “Equator Principles.” We are also using non-financial information, such as our customers’ greenhouse gas emissions and ESG risk responses, to enhance our understanding of the environmental and social risks accompanying credit.

Individual policies have also been established for specific businesses and sectors with a particularly high likelihood of significant environmental and social impact, such as coal-fired power generation and coal mining operations, which are being introduced in line with the business of our Group companies.

We have published the SMBC Group Environmental and Social Framework under which to unify these due diligence systems as well as our approach to environmental and social issues.

Community

SMBC Group believes that people need communities in which they can be involved in their daily lives and their economic activities, through which they can support one another, and in which they can act with peace of mind. Through our businesses, SMBC Group continues to contribute to communities and society and to fulfill our social responsibility as a financial institution that acts within communities.

The advancement of digital platforms facilitating smooth financial transactions for both personal and corporate customers, for example, is essential to the development of both the economy and SMBC Group.

To this end, SMBC Group is working to enhance the value of the services we offer to customers with initiatives including the update of the bank’s application to offer significantly improved convenience for users, and providing cashless terminals with the latest functions.

We moreover believe that our wealth management business, which supports our customers to lead prosperous lives, our elder services which respond to the era of the 100-Year Life and our corporate business which supports our customers’ growth and continuity, will contribute directly to building sustainable communities.

We will continue to enhance our corporate value while fulfilling our responsibilities to the society as a financial institution by enhancing our existing financial solutions and persisting in taking on the challenge of creating diverse businesses serving a new society.

GREEN×GLOBE Partners

In July 2020, we established the “GREEN × GLOBE Partners”, a community for solving environmental and social issues. Its goal is to “spread awareness and opportunities for the resolution of environmental and social issues” by bringing companies and individuals together to solve issues they could not solve on their own. As of the end of June 2022, 543 companies and organizations have joined this community.

Specific activities include distributing articles on environmental and social issues, holding workshops, and planning events and projects. In FY2021, we worked to support the revival of traditional industries through the “Thinking about the Future of Banshu-ori” project and the creation of new projects through food and agriculture-related workshops.

Next Generation

Passing on a sustainable society to future generations demands the development of human resources and industries equipped with the necessary knowledge and skills. SMBC Group is working to foster the next generation to bring about a sustainable society.

For example, Group companies including SMBC, SMBC Venture Capital and SMBC Nikko Securities are working together to support growth companies through financing to promote innovation leading to the realization of social and economic growth for the next generation. In response to the Japanese government’s Science, Technology and Innovation Policy, we are supporting the development of local human resources and industries by running the “mirai cross” acceleration program to support technologies originating from universities and research institutes, and by holding events to promote technological innovation that fit the characteristics of companies and regions.

We are also placing an emphasis on fostering the next generation in our social contribution activities, including financial literacy education. Through its businesses, SMBC Group will further promote initiatives and contributions supporting the fostering of human resources and industries that will shape a better society.

Financial Literacy Education

SMBC Group provides a variety of financial literacy education activities for people of all ages, leveraging the insight and expertise of its Group companies to realize a society in which everyone has a good understanding of money and can live with peace of mind.

In FY2021, we provided more than 1,800 financial literacy seminars with more than 160,000 participants. In addition to online seminars, we have newly expanded our online learning videos to make studying easy and fun.

With the lowering of the age of majority in April 2022, it has become possible to enter into various financial contracts from the age of 18. The ministerial curriculum guidelines for senior high schools have also been revised as financial literacy education grows increasingly important. SMBC Group will develop learning materials for use by all our Group companies, providing contents that tap into current trends such as key points for long-term investment, etc.

- Provided financial literacy education to a total of approximately 298,000 people since FY2020

- Carried out a social impact assessment of financial literacy education, and published this on our website

Initiatives to Address Social Issues

Initiatives to Conserve Natural Capital and Biodiversity

The stability of natural capital is supported by biodiversity: damage to it will result in the loss of natural resources such as plants and animals, air, water and soil, and will ultimately have a significant impact on human life.

SMBC Group strives to understand the potential risks in our assets related to natural capital and their impact on business activities throughout the supply chain.

In January 2022, we joined the TNFD Forum, a stakeholder organization of the Taskforce on Nature-related Financial Disclosures (TNFD), which was founded to establish a framework for corporate risk management and disclosure involving natural capital. We are actively involved in the discussions to create such guidance.

In our business, in light of the impact on natural capital and biodiversity, we are prohibiting the provision of credit to large-scale development and construction projects recognized as having a significant negative impact on Ramsar wetlands and UNESCO World Natural Heritage sites.

We are also requiring palm oil plantation development and large-scale farm development projects to comply with NDPE (No Deforestation, No Peat, No Exploitation). When considering financing for other large-scale projects, we conduct environmental and social risk assessments in accordance with the Equator Principles paying close attention to their impact on primeval forests and ecosystems, mitigation measures, whether or not they include development on peatland, and whether considerations are made for workers and local residents, etc.

“GREEN×GLOBE Partners” and the Japan Research Institute also provide information on TNFD, as well as biodiversity conservation consulting services, and are accelerating their efforts in the belief that this is an important theme for realizing sustainability.

Respect for Human Rights

Companies have responsibility to protect and respect all human rights, and to consider the impact of their business activities, including their supply chain, on the human rights of their customers, their employees and other stakeholders.

Through its Human Rights Awareness Promotion Committee, SMBC Group is promoting human rights awareness among all employees. SMBC Group has further issued the “Statement on Human Rights,” publicized to all stakeholders, in line with the United Nations’ Guiding Principles on Business and Human Rights, in order to address respect for human rights as expressed in the United Nations’ Universal Declaration of Human Rights, the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work and the OECD Guidelines for Multinational Enterprises, etc.

In addition, in April 2022, we established the Sustainable Procurement Policy.

We are committed to respecting human rights throughout all our business activities based on due diligence and remedial measures, with the aim of eliminating all forms of exploitative labor practices, including modern slavery, forced labor, human trafficking, and child labor, from our own operations and supply chains.

Social Contribution Activities

SMBC Group defines social contribution as “voluntarily contributing to the resolution of social issues by making use of our managerial resources expecting nothing in return,” and is undertaking various activities as a good corporate citizen working for and with the society.

We believe that diligent and highly-motivated employees’ efforts to contribute to the society will lead to their personal growth, and actively support them in these efforts.

SMBC Group Rising Fund

We operate the SMBC Group Rising Fund, which is financed through voluntary donations from the salaries of company officers and employees at our Group companies.

The Volunteer Fund, which has been implemented by SMBC since 1998, was expanded to this group fund in April 2021, and we are working to manage the fund at the group level and to create an even greater positive impact.

In FY2021, we made a public appeal for projects working to resolve social issues facing next generation, and have donated a total of ¥15 million to various organizations working to provide financial support to families living in poverty and employment support to young people, etc.

In addition to donations made by officers and employees, SMFG as a company also provides a portion of the donations.

Pro Bono Work

With the aim of further promoting contributions to solve social issues, SMBC Nikko Securities has introduced a “pro bono* work” system, a rare example among Japanese financial institutions, in which a portion of its employees’ working time is devoted to pro bono work.

Through this project, employees who wish to participate work in teams to strengthen infrastructure and support the activities of NPOs and other non-profit organizations, with the goal of expanding and accelerating activities aimed at solving social issues.

A total of 124 officers and employees have worked to support eight organizations since the program’s inception in March 2020.

* Volunteer activities in which professionals use the skills and experience they have gained through their work to provide support oriented toward business aspects, which are often lacking at NPOs and other non-profit organizations.

Support for Grants by the Sumitomo Foundation

We are supporting and promoting the activities of the Sumitomo Foundation through various collaborative initiatives, including donations to the Foundation and the dispatch of officers and employees.

Based on the Sumitomo Group’s business philosophy of “Benefit self and benefit others, private and public interests are one and the same,” the Foundation aims to contribute to the creation of an affluent society with an international perspective, and provides grants for basic scientific research, environmental research and Japan-related research in Asian countries, as well as for the conservation and restoration of cultural properties in Japan and abroad.

An example of restoration of cultural properties: Seated statue of Yakushi Nyorai at Hogyoji Temple