Business Strategies for Creating Value

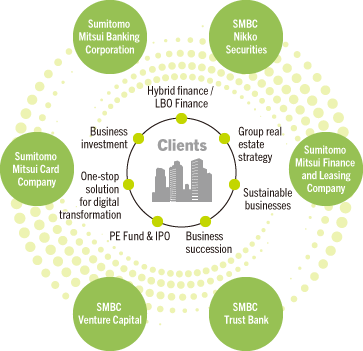

The Wholesale Business Unit contributes to the development of the Japanese economy by providing financial solutions that respond to the diverse needs of domestic companies in relation to financing, investment management, payments, M&A advisory, leasing and real estate brokerage services through a Group-wide effort.

Amid a persistently challenging operating environment, including Japan’s negative interest rate policy, increasing competition, as well as the prolonged COVID-19 pandemic, the Wholesale Business Unit has strived to increase asset efficiency by mustering the collective strength of SMBC Group to deliver sophisticated solutions and carry out operations with an extensive focus on profitability.

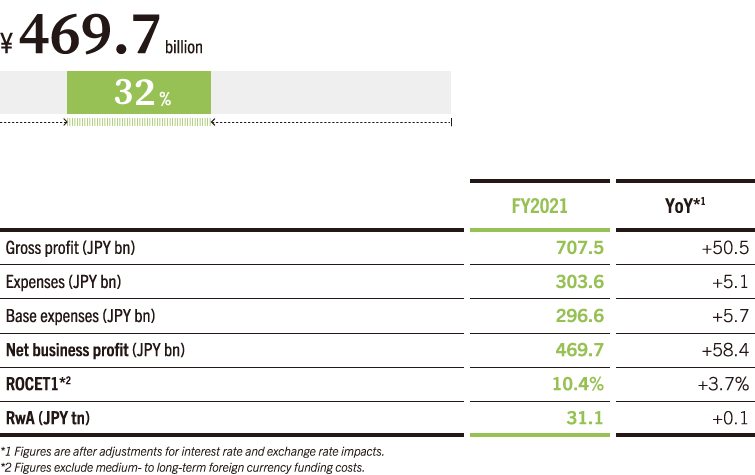

In FY2021, we came together as a united group to address the management issues and needs facing customers who are under pressure to transform their businesses amid great changes to social structures and environments. Our approach entailed supplying an array of solutions for business reorganization, real estate business, cashless and payment services and decarbonization. By proposing ideas in step with the times, we have been able to create a number of opportune businesses, and the Wholesale Business Unit’s net business profit have increased significantly as a result.

In FY2022, the final year of the Medium-Term Management Plan, we expect to see further acceleration towards achieving a decarbonized society, the trend toward digitalization and cashless payments, and review of our business portfolio triggered by the conflict between Russia and Ukraine. SMBC is working to create new businesses together with our customers by promoting approaches with greater sector knowledge to address our customers’ increasingly complex and sophisticated management issues.

In addition, we are further increasing the allocation of management resources to growth fields to create and hone an “edge” for the Group. Going forward, we will further bolster our keen ability to make proposals, our speed, and pioneering spirit, to provide high-value-added solutions that contribute to sustainable growth of SMBC Group and its customers, and to the development of the Japanese economy.

Contribution to Consolidated Net Business Profit (FY2021)

PRIORITY STRATEGY 1

Creating and Honing a Group Edge

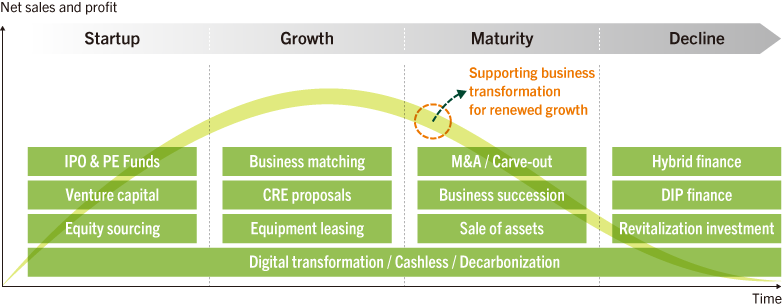

The disruption to supply chains caused by the prolonged COVID-19 pandemic and the conflict between Russia and Ukraine have further increased the business reorganization, financial improvement and corporate revitalization needs of our customers. The Specialized Finance Department, newly established in April 2021, will play a central role in strengthening our ability to provide solutions on a Group-basis to respond to these needs, such as hybrid finance and corporate revitalization investment. Meanwhile, we will allocate management resources to real estate businesses while bolstering coordination between Group companies to strengthen our ability as a Group to propose solutions and support our customers’ CRE strategies. Further allocation of management resources to these growth fields will allow us to construct a business structure able to provide top-tier solutions.

Following the revision to the Banking Act in 2021, SMBC Capital Partners will enter the business of majority investment in industrial companies as a new business. In the medium- to long-term, we are forecasting a bottom line of ¥15 billion, and are accelerating our efforts to achieve the next stage of growth, including leading the restructuring of both growing and established companies, and taking on the challenge of fostering industries. Continued pursuit of these new challenges will create and hone our edge as a group.

Solutions for Each Companies’ Life Stage

PRIORITY STRATEGY 2

Corporate Digital Solutions

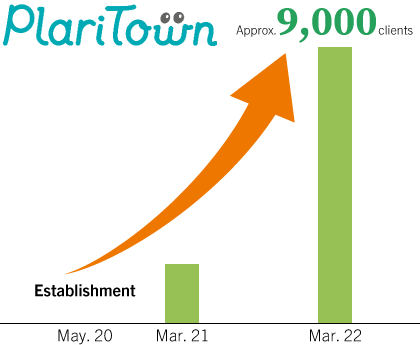

Customers’ digital innovation and digital transformation needs continue to grow, not only among large companies as it has been up to now, but also among mid-sized companies and SMEs. When considering specific initiatives, however, many customers are unsure of where to begin. The Group Solution Promotion Department has therefore been established to help provide one-stop services for the Group companies’ digital solutions. Through tailor-made solution proposals, expanding the PlariTown corporate digital platform services, promoting cashless payments and developing business matching services through Biz-Create, we aim to support the digitalization of mid-sized companies and SMEs and to create new business opportunities.

Number of Registered Companies

Sustainability Initiatives

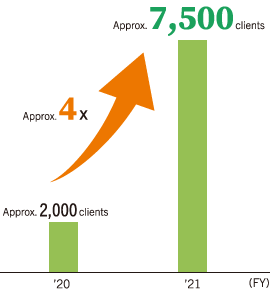

Number of Engagements

The Sustainable Business Promotion Department, established in April 2020, is working to support customers’ sustainability and SDGs initiatives, and to co-create businesses with a view to develop a sustainable society. The rapid expansion of interest and initiatives involving the SDGs and decarbonization among customers has led to an almost four-fold increase in the number of engagements with customers compared to the previous year, and we have further provided approximately ¥1.5 trillion in sustainability-related financing in Japan.

In April 2022, the Sustainable Solutions Department was newly established to bring together sustainability-related functions and knowledge at the group level, strengthen our ability to respond to environmental and social issues, and to promote engagement with customers to support their decarbonization initiatives.

We are aiming to become a global solutions provider that meets our customer’s various sustainability-related needs by developing and promoting various types of sustainable finance, by providing services such as “Sustana” cloud service for calculating and visualizing greenhouse gas emissions, and by supporting customers in solving their sustainability-related management issues.