Business Strategies for Creating Value

The top-class companies in the banking, securities, credit card, and consumer finance industries that comprise the Retail Business Unit are addressing the financial needs of all individual customers through services capitalizing on the Group’s comprehensive strength, striving to develop the most trusted and No. 1 Japanese retail finance business.

The Retail Business Unit possesses the No.1 business foundation in Japan in its principal business areas, including wealth management, payment service, and consumer finance, backed by high-quality consulting capabilities and advanced payment and finance products and services.

In FY2021, as in the previous year, the COVID-19 pandemic continued to affect all businesses, but personal consumption and in particular service consumption recovered and the payments business grew beyond its pre-pandemic level. In the consumer finance business, consumer loan balance declined for the second consecutive year, but this situation is now reversing.

Customer mindsets and behavior have also undergone dramatic changes during the pandemic, including expanding use of cashless payments and digital technology, and growing preparation and inheritance-related needs accompanying the arrival of the 100-Year Life era. Against this backdrop, SMBC Group has been swift to implement measures to address changing customer needs, including consultation through digital and remote channels, introduction of SMBC Elder Program and the shift to 24/7 operation of SMBC Direct service.

In FY2022, the final year of the Medium-Term Management Plan, the Retail Business Unit will advance the main measures set out, namely to accelerate the expansion of the Group’s customer base and earnings, as well as business structure reforms.

In the wealth management business, we will facilitate the growth of the domestic economy by supplying funds to the market while supporting healthy individual asset building to help address people’s post-retirement concerns. At the same time, we will look to capitalize on the business opportunities presented by the overarching shift from saving to asset formation and investment. As for the payment service business, we provide services that are highly convenient for users and business operators alike in response to the increasingly rapid trend toward cashless payments. We are also strengthening our response to point-of-sale financing needs for consumer purchases, which are expected to continue to grow together with the Japanese cashless market.

SMBC is striving to supply high-value-added services, including non-financial services, that go beyond the scope of traditional financial institutions to support the smooth transfer of assets to the next generation.

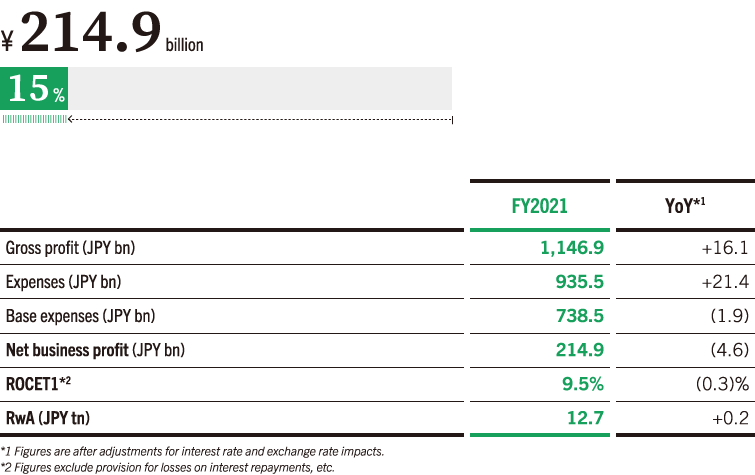

Contribution to Consolidated Net Business Profit (FY2021)

PRIORITY STRATEGY 1

Sustainable Growth in Wealth Management Business

In order to meet the diverse needs of our clients, including needs for high-level wealth management, inheritance and succession and business loans, we are providing “total consulting,” which goes beyond the frame of entities to draw on the strengths of the Group as a whole. We are expanding our product and service lineup, as well as our client base, for business owners and other high-net-worth individuals by enhancing coordination between the planning and front-office functions of our banks and securities companies. We are also meeting our customers’ inheritance needs by managing assets on a group-basis and promoting transactions with next generation customers. To meet the diversifying needs and demands of our customers in the 100-Year Life era, we are offering “SMBC Elder Program,” which includes not only financial services but also non-financial services such as health, security and meaningful lifestyles through a dedicated concierge. Going forward, we will continue to expand our services to support customers as they live longer.

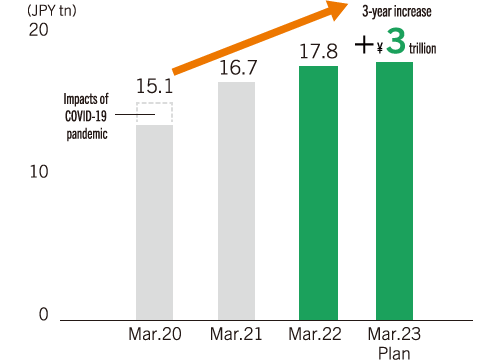

Balance of Fee-Based AUM

PRIORITY STRATEGY 2

Pursuit of No. 1 Position in Payment Service Business

In the payments field, the COVID-19 pandemic has triggered the acceleration of the trend toward cashless payments and digitalization. SMBC Group will respond to this trend by delivering even more convenient services. For users, we are promoting high-security numberless cards and group-wide point services in order to accelerate improved convenience and growth of our customer base. For business operators, we seek to expand our market share as well as the scope of our business by promoting our next-generation payments platform “stera” and low-priced content subscription services.

As for consumer finance businesses, we aim to meet the financing needs of even greater number of customers by utilizing Group expertise to bolster product lineups.

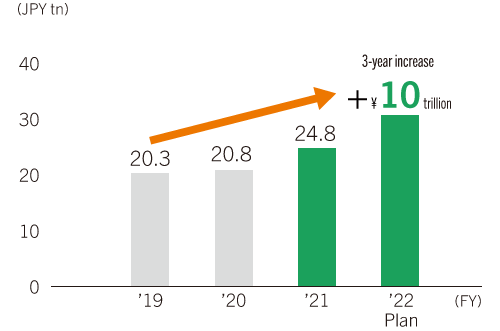

Sales Handled

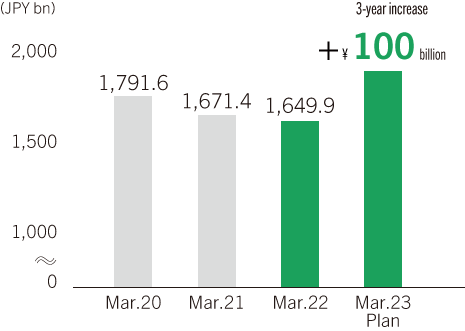

Consumer Loan Balance

PRIORITY STRATEGY 3

Reinforcement of Consulting Businesses through Branch Reorganizations

SMBC is pursuing “fast and customer-friendly service,” tailored to the changing needs and behaviors of its customers by increasing the number of procedures that can be completed digitally or remotely, and improving video chat functions. It is also strengthening its ability to respond to requests in-store through the use of in-store appointments, including, for example, providing high value-added consulting services tailored to customer needs after administrative procedures have been completed.

Through the development of joint branches shared by SMBC, SMBC Nikko Securities, and SMBC Trust Bank, we will provide one-stop service and achieve both greater convenience for customers and more efficient branch operations.

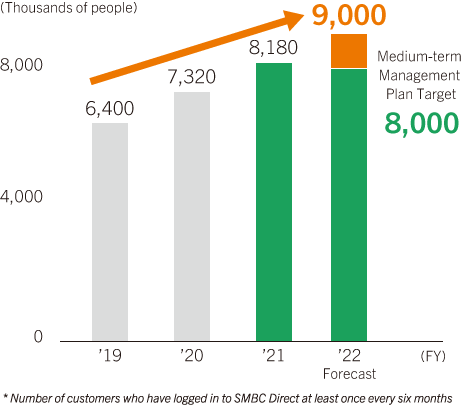

Number of “SMBC Direct” Users*

Sustainability Initiatives

In April 2022, we established “SMBC Family Works” in order to ease customers’ concerns about their future as we enter the 100-Year Life era.

Through applications, we will provide a platform for visualizing risk from the perspectives of “money,” “health” and “lifestyle,” support for monitoring family members, so that users can communicate with their family to consider specific preparations for the future.

In order to bring about a sustainable society, we select companies to invest in based on their ESG initiatives, and provide investment products that are focused on companies that aim to contribute to society. Going forward, we will continue to expand our range of investment products in order to respond to customers’ growing awareness of sustainability initiatives.

In terms of environmental initiatives, we are promoting the reduction of greenhouse gas emissions by offering special interest rates on personal loans for environmentally friendly housing, and accelerating transition to paperless operation through digital transformation.