Business Strategies for Creating Value

The Global Business Unit supports the global business operations of domestic and overseas customers by leveraging SMBC Group’s extensive global network and products and services in which we possess strengths.

FY2021 presented an extremely challenging business environment, with the Russian invasion of Ukraine at the end of February adding to ongoing effects from the COVID-19 pandemic, but the group as a whole was able to make steady progress with the main initiatives of the Medium-Term Management Plan. Specifically, in order to strengthen our overseas securities business, we entered into a capital and business alliance with Jefferies Financial Group, a general brokerage firm in the U.S., and, with a view to expanding our Asian financial franchise, we have made a number of acquisitions and partnerships that will form a pillar of future growth, including investments in non-banks in India and Vietnam and in a commercial bank in the Philippines. We are also focusing on enhancing governance, while in the Americas, we are strengthening the functions of the bank holding company’s board of directors. In terms of performance, continued increases in revenue and profitability since FY2020 were achieved through successful initiatives involving products benefitting from inflows into the fund.

We will continue to focus on the priority measures in FY2022, the final year of the Medium-Term Management Plan. In the CIB Business, which combines banking and securities operations, we are strengthening our sector approach and deepening collaboration with Jefferies. In the Asian financial franchise, we are accelerating our growth strategy by focusing on post-merger integrations through the newly established “Asia Business Development Division.” We are also taking on the challenge of digitalization in an expanded range of regions and fields.

Through these efforts, we will drive the sustainable growth of SMBC Group. At the same time, we are also establishing a framework to support this growth, i.e., strengthening group governance and building corporate infrastructure in anticipation of complex environmental changes including climate change and the circumstances in various countries.

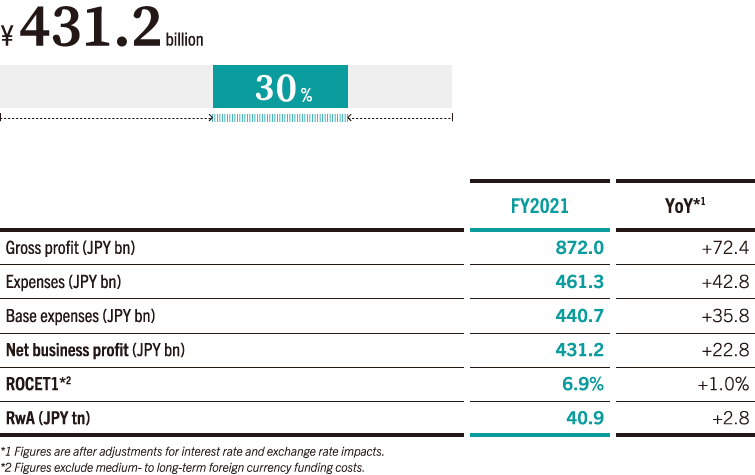

Contribution to Consolidated Net Business Profit (FY2021)

PRIORITY STRATEGY 1

Enhancement of CIB Business

We are enhancing the CIB Business, in a unique manner, by taking a sector approach and leveraging our global network to capture deals. We will provide high value-added financial services that respond to customers’ challenges, such as financial strategy and product proposals, and will seek to expand cross-selling. Product lineups will be expanded in businesses with funds seeing brisk inflows.

Collaboration with Jefferies has already resulted in the execution of a number of LBO deals, and we look forward to further expanding the scope of our collaboration. We have also strengthened our bond sales and trading operations in the U.S. by increasing headcount and capital in order to develop our investor-oriented business.

Through these efforts, we aim to create an even more profitable and efficient business model.

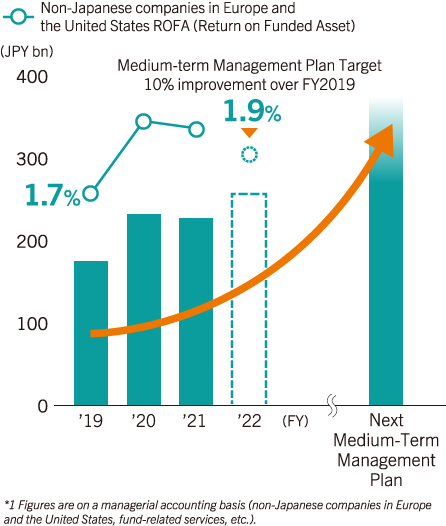

Gross Profit in Corporate Investment Banking Business*1

PRIORITY STRATEGY 2

Initiatives in Growth Areas

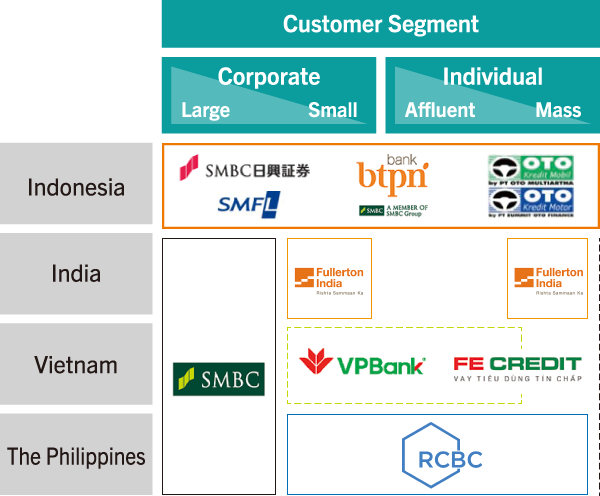

We are developing our financial franchise in Asia through investments. The newly established Asia Business Development Division will implement smooth post-merger integration, including establishing governance structures, in the companies in which we invest, and accelerate our growth strategy.

In asset management, we are working together with our business partners Ares Management Corporation in the U.S. and ESR Group in Hong Kong to further expand our fields of business as a group, with a particular focus on Asia.

Bank BTPN has added functions to its mobile banking service “Jenius” to improve its convenience, including credit card, mutual fund, and insurance sales functions, and has launched digital services for small and medium-sized enterprise customers. We are working to increase the added-value of our services through digital measures not only in Indonesia but also in various other regions and businesses.

Expansion of Financial Franchise in Asia

PRIORITY STRATEGY 3

Further Enhancement of Management Foundations

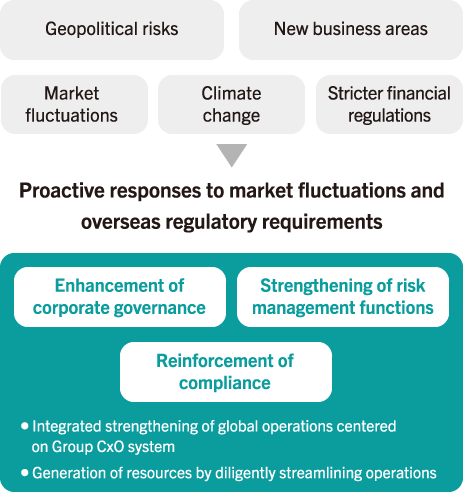

To support business expansion, we are prioritizing resource allocation to strengthening governance, risk management, and compliance systems.

In the U.S., bank holding company is enhancing its board of directors’ functions by, for example, ensuring a majority makeup of outside directors. A CxO system was also introduced to create a structure for unified and appropriate management of the business in the U.S., which encompasses a variety of business areas.

In Germany, our bank and securities companies will merge to become a universal bank. The company will work as one to strengthen regulatory compliance and governance.

Continuing to strengthen the management foundations of SMBC Group is essential to the global expansion of our business and to achieving sustainable growth.

Sustainability Initiatives

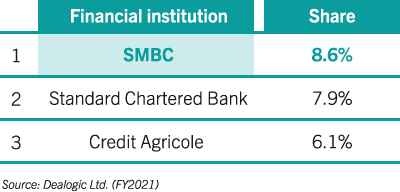

Global League Table

(Green Loan Amounts)

Dedicated sustainability teams in each region are working together at the global level to strengthen the ability of SMBC Group as a whole to make proposals and to provide solutions.

In October 2021, the Group originated an approximately US$1.25 billion sustainability-linked loan to a major LNG provider in the U.S. The terms of the loan will vary according to efforts to visualize and reduce greenhouse gas emissions throughout the customer’s entire supply chain. Going forward, we will be providing services to support our customers’ energy transition efforts. We are also working to expand our product lineup, including green deposits.We have been successful in these efforts, and in FY2021 we attained a high presence in green loans in particular, and ranked first in the global league table.

We are also striving to provide a wide range of financial services accessible to all customers. In Indonesia, we are providing loans to low-income women through BTPN Syariah, while in India, Fullerton India is providing microfinance in rural areas.