4. Completing repayment of public funds

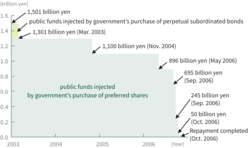

Having posted a record high of 686.8 billion yen in consolidated net income for fiscal year 2005 (ended March 2006), SMFG began in the following fiscal year to engage in the repayment of public funds injected in the past.

The company obtained approval of a limited amount for acquiring its own shares at two ordinary general shareholders’ meetings, held in 2005 and 2006. The company bought back preferred shares and debentures beginning in May 2006. In October 2006, the injected public funds were fully repaid, which was 18 months ahead of the schedule submitted to the government.

On the day when the full repayment was fulfilled, SMFG issued a press release to report the fact and express its appreciation for the taxpayer-funded aid. The company also emphasized its unbending resolution to establish itself as a financial institution that can honor the utmost confidence of customers, shareholders, the market and society.

-

Chapter 1The Financial Crisis and Realignment of the Financial Sector

-

Chapter 2The Birth of SMBC and SMFG

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

- Enhancing our retail consulting and payments & consumer finance businesses

- Enhancing corporate financial solutions

- Banking-Securities collaboration in the wholesale securities business

- Challenges facing our global banking business

- Actions by Treasury Unit in preparation for rising interest rates

- Integration of operating systems and administrative functions

-

-

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

- Changes of leadership and the announcement of our new management policy

- Developing group business strategies

- Addressing antitrust issues

- Completing repayment of public funds

- LEAD THE VALUE

- Enhancing our retail financial consulting business

- Enhancing our corporate solution business

- Enhancing our investment banking business

- Global banking business turnaround

- Upgrading risk management in preparation for Basel II

- Development of human resources

- CSR activities

-

-

-

Chapter 5SMFG’s Response to Global Economic and Financial Turmoil

-

Chapter 6Preparing for the Next Decade

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

- Our journey under new leadership (the second decade)

- Focusing on growth industries and businesses

- Reforming domestic business operations

- Promoting banking-securities collaboration in Wholesale Banking Unit

- Structural reform of our retail business

- Meeting the needs of an aging society

- Abenomics and Treasury Unit's nimble portfolio management

- Operating in a negative-interest-rate environment

-

-

-

Chapter 2Enhancing Group Businesses

-

Chapter 3Expanding Our Global Business

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

- New leadership and enhancing corporate governance

- Introducing group-wide business units and CxO system

- Improving capital, asset, and cost efficiency

- Pursuing our cashless payment strategies

- Retail branch reorganization

- Customer-oriented business conduct

- Enhancing internal-control frameworks

- Valuing diversity and revision of our HR framework

-

-

-

Chapter 5The Path for Our Future

-

Chapter 6Opening a New Chapter in SMBC Group’s History