5. Structural reform of our retail business

Results of the retail banking business remained flat or edged down starting in fiscal year 2008, owing mainly to slower growth of personal financial assets and diminishing returns of interest resulting from declining interest rates.

To address this situation, SMFG implemented structural reforms for the retail banking business to improve functions related to financial consulting for individuals, which was one of the five key strategic business areas in the medium-term management plan started in fiscal year 2011.

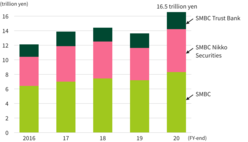

In one major example, SMBC and SMBC Nikko Securities launched new banking-securities collaboration models in July 2014, replacing the previous style in which the two partners engaged in wealth management independently. The new model was designed to encourage the two companies to offer products and services of both companies by introducing each company’s customers to the other company, which could achieve the best interests of our retail customers. The business model shifted to a group-based wealth management business. Similar mutual referral partnership programs were run by SMBC, SMBC Trust Bank and SMBC Nikko Securities, to boost the capacity to effectively meet needs of more potential customers, which resulted in steady growth in the group total balance of assets under management.

At the same time, in order to maintain medium- to long-term competitiveness in the retail asset management market, thereby achieving sustainable growth of businesses, the Group focused more on the wealth management business based on the balance of investment products. For this purpose, the Group ran a training to build up consulting skills to offer products and services that could effectively accommodate the individual needs of customers. Performance measurement framework was also revised to align with the above shift of focus in business models on a group basis.

-

Chapter 1The Financial Crisis and Realignment of the Financial Sector

-

Chapter 2The Birth of SMBC and SMFG

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

- Enhancing our retail consulting and payments & consumer finance businesses

- Enhancing corporate financial solutions

- Banking-Securities collaboration in the wholesale securities business

- Challenges facing our global banking business

- Actions by Treasury Unit in preparation for rising interest rates

- Integration of operating systems and administrative functions

-

-

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

- Changes of leadership and the announcement of our new management policy

- Developing group business strategies

- Addressing antitrust issues

- Completing repayment of public funds

- LEAD THE VALUE

- Enhancing our retail financial consulting business

- Enhancing our corporate solution business

- Enhancing our investment banking business

- Global banking business turnaround

- Upgrading risk management in preparation for Basel II

- Development of human resources

- CSR activities

-

-

-

Chapter 5SMFG’s Response to Global Economic and Financial Turmoil

-

Chapter 6Preparing for the Next Decade

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

- Our journey under new leadership (the second decade)

- Focusing on growth industries and businesses

- Reforming domestic business operations

- Promoting banking-securities collaboration in Wholesale Banking Unit

- Structural reform of our retail business

- Meeting the needs of an aging society

- Abenomics and Treasury Unit's nimble portfolio management

- Operating in a negative-interest-rate environment

-

-

-

Chapter 2Enhancing Group Businesses

-

Chapter 3Expanding Our Global Business

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

- New leadership and enhancing corporate governance

- Introducing group-wide business units and CxO system

- Improving capital, asset, and cost efficiency

- Pursuing our cashless payment strategies

- Retail branch reorganization

- Customer-oriented business conduct

- Enhancing internal-control frameworks

- Valuing diversity and revision of our HR framework

-

-

-

Chapter 5The Path for Our Future

-

Chapter 6Opening a New Chapter in SMBC Group’s History