4. Taking part in the digital revolution

In the 2010s, a new breed of financial services based on information technology—known as financial technology (fintech)—arose, driven by the rapid progress of the digital revolution. SMFG saw in this trend a significant opportunity to create new businesses and improve convenience and productivity. The company began from the initial stage of the digital revolution to carry out various programs to develop digital technology-enabled new businesses by using open innovation platforms as well as to digitize its financial operations.

In October 2015, each of SMFG and SMBC set up an IT Innovation Department to serve as SMBC Group’s innovation hubs. Then, in September 2017, the Group launched an open innovation center named hoops link Tokyo in Shibuya-ku, Tokyo, for the purpose of facilitating innovative activities by utilizing external technologies and ideas.

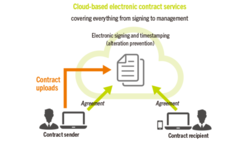

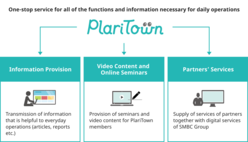

Meanwhile, the Group invested substantially in digital platform development. Its major use was for providing biometric authentication (Polarify), electronic contract (SMBC CLOUDSIGN), and other digital service options, while offering unconventional services at the same time. Also, the corporate digital platform PlariTown was rolled out in August 2020, for the purpose of supporting digital transformation (DX) of mid-tier corporate and small- to medium-sized enterprise (SME) customers.

In April 2016, noting the need to raise the digital literacy of the entire Group workforce in order to deal with issues related to digitization-driven business model transformation, SMFG, SMBC and Japan Research Institute jointly formed SMFG IT University, an in-house IT learning & training institution, which was relaunched in April 2019 as the Digital University.

-

Chapter 1The Financial Crisis and Realignment of the Financial Sector

-

Chapter 2The Birth of SMBC and SMFG

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

- Enhancing our retail consulting and payments & consumer finance businesses

- Enhancing corporate financial solutions

- Banking-Securities collaboration in the wholesale securities business

- Challenges facing our global banking business

- Actions by Treasury Unit in preparation for rising interest rates

- Integration of operating systems and administrative functions

-

-

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

- Changes of leadership and the announcement of our new management policy

- Developing group business strategies

- Addressing antitrust issues

- Completing repayment of public funds

- LEAD THE VALUE

- Enhancing our retail financial consulting business

- Enhancing our corporate solution business

- Enhancing our investment banking business

- Global banking business turnaround

- Upgrading risk management in preparation for Basel II

- Development of human resources

- CSR activities

-

-

-

Chapter 5SMFG’s Response to Global Economic and Financial Turmoil

-

Chapter 6Preparing for the Next Decade

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

- Our journey under new leadership (the second decade)

- Focusing on growth industries and businesses

- Reforming domestic business operations

- Promoting banking-securities collaboration in Wholesale Banking Unit

- Structural reform of our retail business

- Meeting the needs of an aging society

- Abenomics and Treasury Unit's nimble portfolio management

- Operating in a negative-interest-rate environment

-

-

-

Chapter 2Enhancing Group Businesses

-

Chapter 3Expanding Our Global Business

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

- New leadership and enhancing corporate governance

- Introducing group-wide business units and CxO system

- Improving capital, asset, and cost efficiency

- Pursuing our cashless payment strategies

- Retail branch reorganization

- Customer-oriented business conduct

- Enhancing internal-control frameworks

- Valuing diversity and revision of our HR framework

-

-

-

Chapter 5The Path for Our Future

-

Chapter 6Opening a New Chapter in SMBC Group’s History