Chapter 3

Expanding Our Global Business

1. Global banking business: going on the offensive

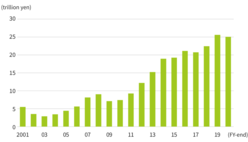

Looking back, we can see that the global financial crisis provided SMBC Group with opportunities to expand its global business. During the first half of fiscal year 2007 (ended March 2008), Sumitomo Mitsui Banking Corporation (SMBC) sold off most of the subprime mortgage-backed securities it held, thus minimizing direct losses related to such products when the financial crisis occurred. Although the sharp economic slowdown had a considerable impact on the performance of the bank, such as with the increase of credit costs and decline of stock prices, the losses incurred by the bank due to the financial crisis were limited, in contrast to what happened to many major U.S. and European financial institutions. European banks, in particular, suffered from the ensuing European sovereign debt crisis over years, which forced many of them to reduce assets and sell off businesses. In fiscal year 2010, SMBC began to deploy global business strategies, seeking to capture a greater market share by taking advantage of this situation. Its own capital basis was strengthened by the issuance of common stock during fiscal year 2009, which also favored the strategy.

One of the key issues facing SMBC in expanding its overseas business was funding in foreign currencies to meet the increasing demand for foreign currency-denominated assets. The International Banking Unit and Treasury Unit worked together to ensure stable funding in foreign currencies. The major potential methods of these included foreign currency deposits, certificates of deposit (CDs), commercial paper (CP), foreign currency-denominated corporate bonds, and currency swaps (buying foreign currencies with yen funds). By fiscal year 2016, the amount of foreign currency deposits and medium- to-long term marketable securities, including corporate bonds, exceeded that of foreign currency-denominated loans and other assets.

-

Chapter 1The Financial Crisis and Realignment of the Financial Sector

-

Chapter 2The Birth of SMBC and SMFG

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

- Enhancing our retail consulting and payments & consumer finance businesses

- Enhancing corporate financial solutions

- Banking-Securities collaboration in the wholesale securities business

- Challenges facing our global banking business

- Actions by Treasury Unit in preparation for rising interest rates

- Integration of operating systems and administrative functions

-

-

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

- Changes of leadership and the announcement of our new management policy

- Developing group business strategies

- Addressing antitrust issues

- Completing repayment of public funds

- LEAD THE VALUE

- Enhancing our retail financial consulting business

- Enhancing our corporate solution business

- Enhancing our investment banking business

- Global banking business turnaround

- Upgrading risk management in preparation for Basel II

- Development of human resources

- CSR activities

-

-

-

Chapter 5SMFG’s Response to Global Economic and Financial Turmoil

-

Chapter 6Preparing for the Next Decade

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

- Our journey under new leadership (the second decade)

- Focusing on growth industries and businesses

- Reforming domestic business operations

- Promoting banking-securities collaboration in Wholesale Banking Unit

- Structural reform of our retail business

- Meeting the needs of an aging society

- Abenomics and Treasury Unit's nimble portfolio management

- Operating in a negative-interest-rate environment

-

-

-

Chapter 2Enhancing Group Businesses

-

Chapter 3Expanding Our Global Business

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

- New leadership and enhancing corporate governance

- Introducing group-wide business units and CxO system

- Improving capital, asset, and cost efficiency

- Pursuing our cashless payment strategies

- Retail branch reorganization

- Customer-oriented business conduct

- Enhancing internal-control frameworks

- Valuing diversity and revision of our HR framework

-

-

-

Chapter 5The Path for Our Future

-

Chapter 6Opening a New Chapter in SMBC Group’s History