2. Introducing group-wide business units and CxO system

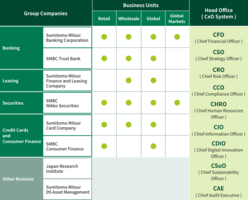

Prior to the shift to a “Company with a Nominating Committee, etc.” SMFG introduced group-wide business units and the CxO system in April 2017 to bolster the group management structure. Specifically, four business units―the Retail Business Unit, Wholesale Business Unit, International Business Unit (renamed the Global Business Unit in April 2020), and Global Markets Business Unit―were formed in accordance with each customer segment, and a head was assigned to each business unit to oversee the operations of the unit across the Group. Also, with the purpose of reinforcing the group management framework centering on SMFG, nine Group CxOs, including the Group CEO, were assigned to undertake overall management of the relevant head office functions.

Behind these initiatives for enhancing the group management structure were the following three primary reasons related to internal and external factors: 1. Out of the total amount of consolidated gross profit posted in fiscal year 2016, 38% was attributable to group companies excluding SMBC, representing a significant increase from 18% in fiscal year 2002; 2. In order to respond to the increasingly sophisticated and diversifying needs of customers, it was imperative to increase capabilities to build group-wide business development strategies and provide products and services best suited to each customer in a seamless manner and on a group-wide basis; and 3. In order to address tightening regulations and oversight processes targeting global financial institutions on a consolidated basis, represented by Basel III standards, it was an urging issue to build a solid management structure on a group-wide basis and on a global scale as well as improve capital and asset efficiency.

-

Chapter 1The Financial Crisis and Realignment of the Financial Sector

-

Chapter 2The Birth of SMBC and SMFG

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

Chapter 3Initiatives Pursued by SMBC Banking Units in the Early Years

-

- Enhancing our retail consulting and payments & consumer finance businesses

- Enhancing corporate financial solutions

- Banking-Securities collaboration in the wholesale securities business

- Challenges facing our global banking business

- Actions by Treasury Unit in preparation for rising interest rates

- Integration of operating systems and administrative functions

-

-

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

Chapter 4Embarking on Fresh Challenges Under New Leadership

-

- Changes of leadership and the announcement of our new management policy

- Developing group business strategies

- Addressing antitrust issues

- Completing repayment of public funds

- LEAD THE VALUE

- Enhancing our retail financial consulting business

- Enhancing our corporate solution business

- Enhancing our investment banking business

- Global banking business turnaround

- Upgrading risk management in preparation for Basel II

- Development of human resources

- CSR activities

-

-

-

Chapter 5SMFG’s Response to Global Economic and Financial Turmoil

-

Chapter 6Preparing for the Next Decade

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

Chapter 1Business Model Reform Under Challenging Business Conditions

-

- Our journey under new leadership (the second decade)

- Focusing on growth industries and businesses

- Reforming domestic business operations

- Promoting banking-securities collaboration in Wholesale Banking Unit

- Structural reform of our retail business

- Meeting the needs of an aging society

- Abenomics and Treasury Unit's nimble portfolio management

- Operating in a negative-interest-rate environment

-

-

-

Chapter 2Enhancing Group Businesses

-

Chapter 3Expanding Our Global Business

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

Chapter 4Enhancing Corporate Infrastructure Under a New Governance Framework

-

- New leadership and enhancing corporate governance

- Introducing group-wide business units and CxO system

- Improving capital, asset, and cost efficiency

- Pursuing our cashless payment strategies

- Retail branch reorganization

- Customer-oriented business conduct

- Enhancing internal-control frameworks

- Valuing diversity and revision of our HR framework

-

-

-

Chapter 5The Path for Our Future

-

Chapter 6Opening a New Chapter in SMBC Group’s History